What is Ponzi Scheme & How its work in market

How Ponzi scheme work to earn money ?

How to save yourself from fraudulent scheme.

What SEBI rules & regulation for Ponzi scheme.

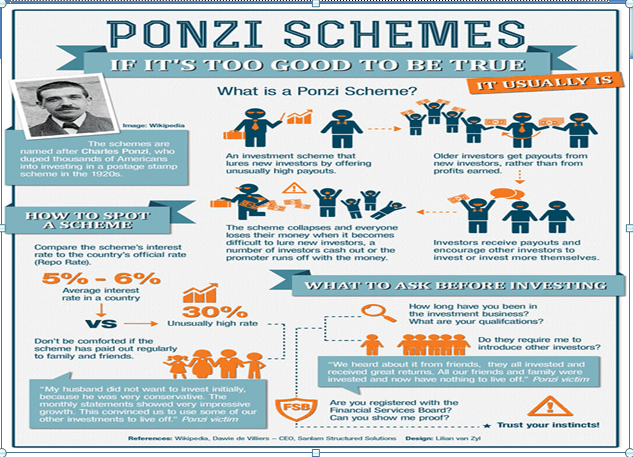

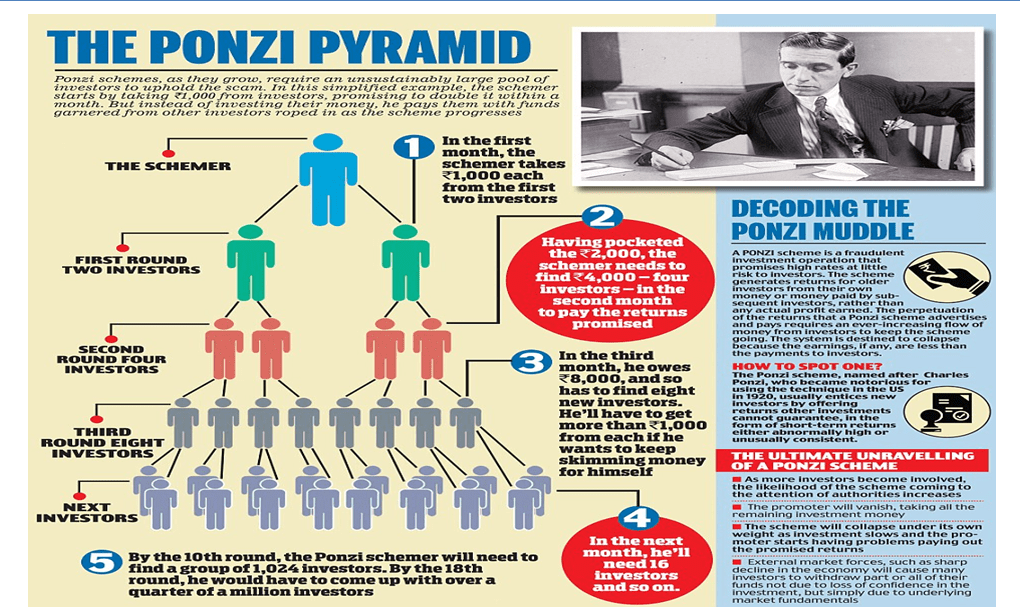

Ponzi schemes are the fraudulent activities to collect the money from investor without getting approval from the regulators. The scheme promoter pretend to investor that he is running a registered company but in real life he did not get approval from anyone like : RBI, SEBI, IRDA, PFRDA etc. He just lure the investor to provide high return on the capital and innocent investor give money to them. Promoter of the scheme also give some money back the the person who helps them to get more clients for the scheme.

How Ponzi Schemes popular in the World : –

Ponzi scheme is named after Mr. Charles Ponzi use money making techniques by giving 50% return promise to the investor in 1920. He promised clients a 50% profit within 45 days, or 100% profit within 90 days, by buying discounted postal reply coupons in other countries and redeeming them at face value in the United States as a form of arbitrage.In reality, Ponzi was paying earlier investors using the investments of later investors. While this type of fraudulent investment scheme was not originally invented by Ponzi, it became so identified with him that it now is referred to as a “Ponzi scheme”. His scheme ran for over a year before it collapsed, costing his “investors” $20 million.

Ponzi may have been inspired by the scheme of William F. Miller, a Brooklyn bookkeeper who in 1899 used the same scheme to take in $1 million.

Source :- Wikipedia

How Ponzi Schemes Work to make money :-

Ponzi scheme also known as – collective investment schemes (CIS).

What is CIS Scheme as per SEBI regulation: –

- Any scheme or arrangement which satisfies the conditions referred to in sub-section (2) or (2A) shall be a collective investment scheme.

- “(2) Any scheme or arrangement made or offered by any person* under which,—

(i) the contributions, or payments made by the investors, by whatever name called, are pooled and utilized for the purposes of the scheme or arrangement;-

(POOLING OF CONTRIBUTIONS)

(CONTRIBUTIONS WITH A VIEW TO RECEIVE PROFITS

(SCHEME PROPERTY IS MANAGED ON BEHALF OF INVESTORS)

(INVESTOR HAS NO CONTROL OVER DAY -TO – DAY MANAGEMENT/OPERATIONS

(2A)* – “Provided that any pooling of funds under any scheme or arrangement, which is not registered with the Board or is not covered under sub-section (3),

involving a corpus amount of one hundred crore rupees or more shall be deemed to be a collective investment scheme”.

*inserted by The Securities Laws (Amendment) Act, 2014

What is the Nature of Ponzi Schemes :-

- Plantation

- Food Processing

- Dairy Farming & Livestock

- Hotel and Resorts

- FMCG sectors

- Information Technology

Which schemes are exempted from PONZI / CIS by law :-

- Co-operative society registered under the Cooperative Societies Act,1912

- NBFC as defined in clause (f) of S.45-I of the RBI Act,1934

- Contract of insurance to which the Insurance Act, 1938 applies

- Any scheme, Pension Scheme or Insurance Scheme under Employee Provident Fund and Miscellaneous Provisions Act, 1952

- Deposits u/s 58A of the Companies Act, 1956

- Chit business as defined in clause (d) of Section 2 of the Chit Fund Act, 1982

- Nidhi or a Mutual Benefit Society u/s 620A Companies Act

ISFM Recommendation:-

Investors should not belive in such kind of scheme, and never give money to anyone agent who belongs to PONZI activities. If anyone want to know about weather the scheme is valid or not then you can call to the SEBI helpline number which are 1800227575, 1800267575 to know exact information. We must use govt authorized scheme for investment and tax planning.

Please note : Only one scheme is registered as a CIS with SEBI, name GIFT but the scheme never work.

October 2008 – GIFT Collective Investment Management Company Ltd. a joint venture between Gujarat Urban Development Company and IL& FS