In the ever-evolving world of the stock market, options trading has emerged as a high-potential avenue for savvy investors. But to truly harness its power, one must understand the options chain—a foundational yet often overlooked tool. In this guide, we’ll …

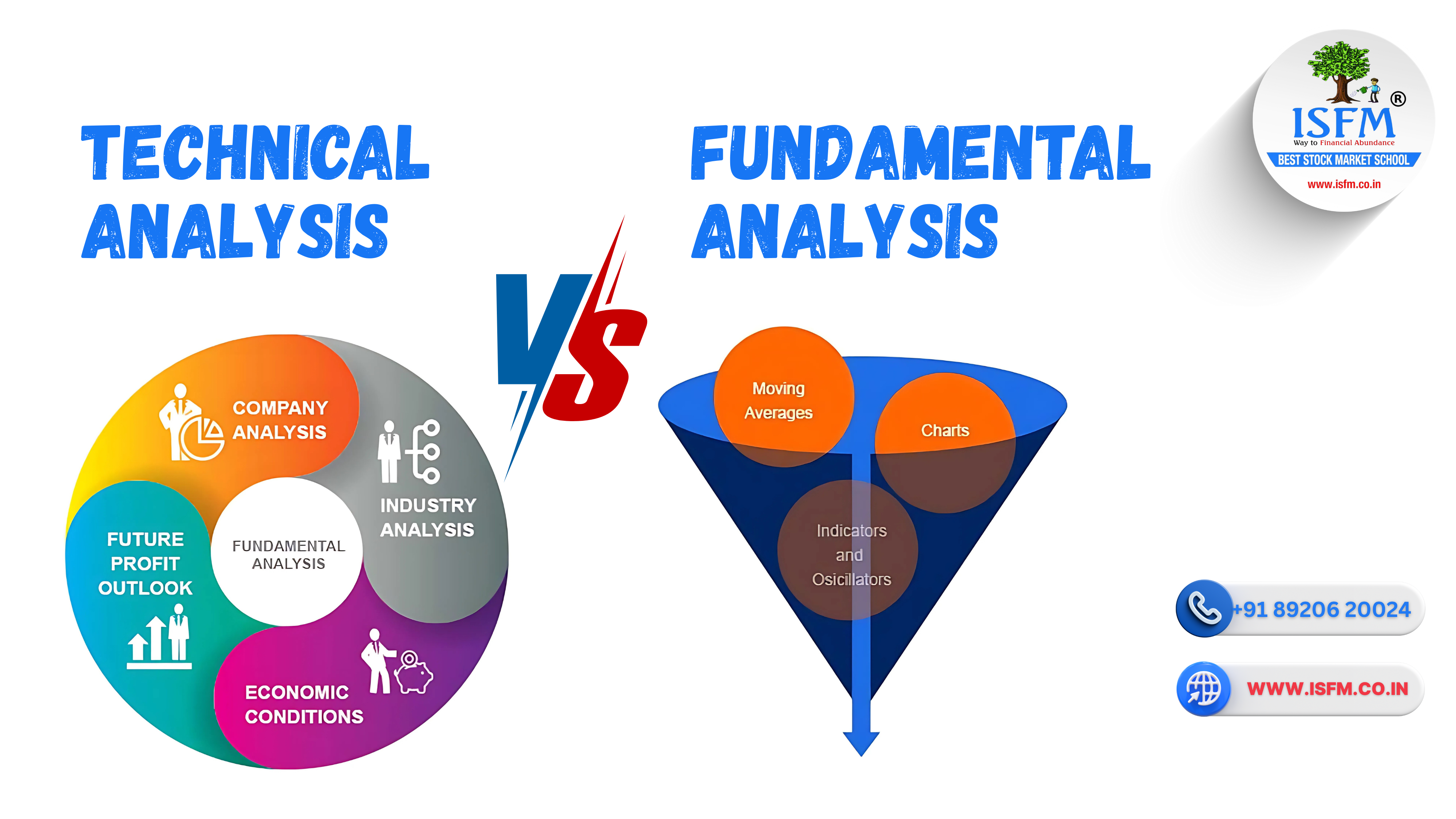

In the ever-evolving world of trading and investing, understanding market movements is essential for success. Two primary analytical methods dominate this space—technical analysis and fundamental analysis. While both aim to forecast future price movements and enhance profitability, their methodologies differ …

Diving into stock trading without adequate experience can be risky. That’s where paper trading apps come in—they allow you to simulate real-time trades using virtual money. Whether you’re a beginner or refining strategies as a seasoned trader, paper trading helps …

In the evolving landscape of stock markets, virtual trading apps in India have become essential tools for anyone looking to enter or excel in the trading world. Whether you’re a beginner eager to learn or an expert refining strategies, these …

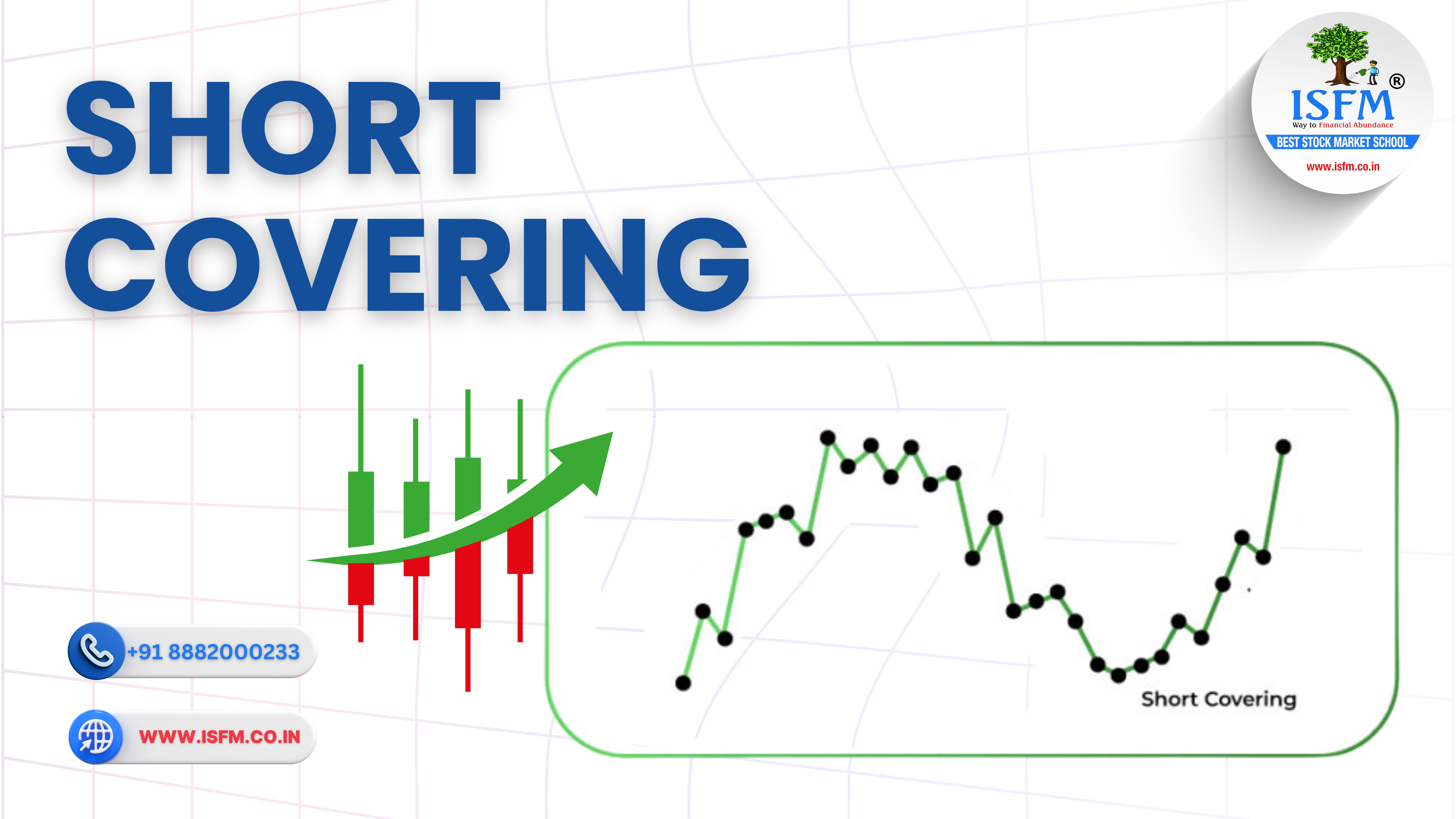

Short covering refers to the act of buying back previously short-sold shares to close an open position. Traders initiate this move to lock in profits or minimize losses when the stock price moves against their expectations. For beginners: Short selling …

In the dynamic world of options trading, identifying market sentiment is crucial for success. One such powerful indicator is short buildup, which can signal a bearish outlook among traders. This comprehensive guide explains the concept of short buildup, how to …

The Indian stock market is growing rapidly, attracting thousands of new investors and job-seekers every day. With this boom, there’s a rising demand for quality stock market courses that offer practical skills, certifications, and placement opportunities. If you’re looking to learn trading, technical analysis, …

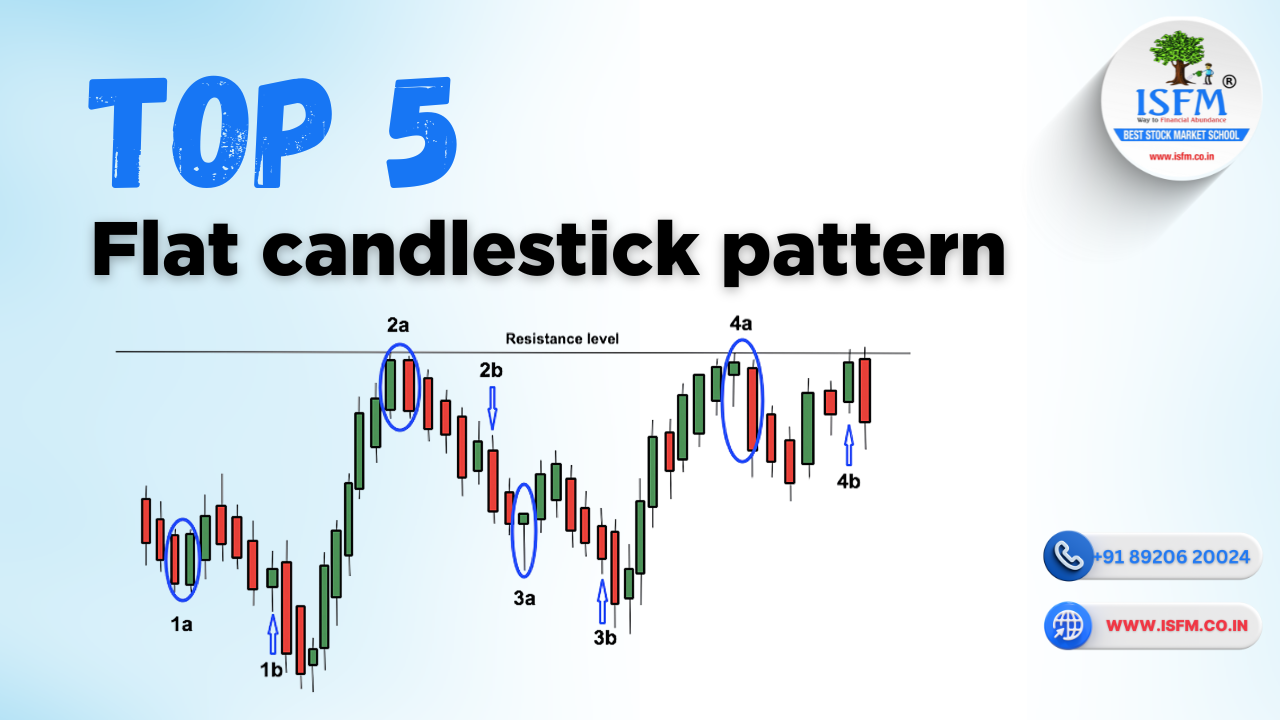

In technical analysis, not every candlestick signals a clear direction. Some candles represent indecision, exhaustion, or balance between buyers and sellers. These are known as Flat Candlestick Patterns—neutral setups that often appear before major breakouts or reversals. In this blog, we will …

If you’re looking to build a successful career in the stock market, mutual funds, or investment advisory, getting certified by NISM (National Institute of Securities Markets) is the best starting point. NISM certifications are SEBI-mandated and highly valued in the financial services industry. Whether you’re a student, fresher, …

If you’re looking to catch strong bullish moves early, then the Three White Soldiers candlestick pattern is one of the most reliable signals in technical analysis. This visually clear and powerful formation signals the end of a downtrend and the …