Why is MCX is the Best Investment Opportunity for Future Growth?

With the rise of retail participation, cutting-edge algorithmic trading, and favorable regulations from SEBI, now is the perfect time to invest in MCX (Multi Commodity Exchange of India), the country’s leading commodity derivatives platform.

MCX controls approximately 96% of the market share in commodity futures and 99% in commodity options trading, making it a dominant force in India’s commodity derivatives space.

Why is MCX is the Best Investment Opportunity?

Several factors are making MCX an attractive investment right now:

- Rising Retail Participation: Retail investors are flocking to commodity derivatives, thanks to easier access and lower capital requirements.

- Algorithm-Driven Trading: The growing popularity of algorithm-based trading is significantly boosting trading volume and liquidity at MCX.

- Favorable SEBI Regulations: SEBI has introduced several regulations that favor increased trading activity, such as allowing mutual funds to trade in commodity derivatives.

- Cost-Saving Technology: Recently, MCX transitioned to a new trading platform developed by Tata Consultancy Services (TCS), which is projected to reduce annual software expenses by up to 80%.

MCX Stock Valuation

MCX currently trades at approximately 40x its projected FY25 earnings, a valuation that aligns with its five-year median P/E and is slightly below its ten-year average. This makes it a reasonably priced stock with room for steady long-term growth.

Who Should Invest in MCX?

MCX is the best investment opporutnity suited for investors seeking long-term, steady growth. It’s a mid-cap company operating in the volatile commodity derivatives market. Earnings can fluctuate based on changes in commodity prices, which are sensitive to geopolitical and macroeconomic factors. Also, trading volumes at MCX are often tied to the overall health of the economy.

However, MCX provides consistent dividends and is debt-free, making it a reliable choice for those comfortable with the risks.

Who Should Not Invest in MCX?

MCX may not be suitable for investors looking for quick, high-risk returns. This stock is more likely to offer consistent, steady growth rather than doubling your money in a short period. Investors should expect steady but moderate gains.

Stock Volatility

MCX’s stock has a beta of 0.8x relative to the Sensex, indicating that it is less volatile than the broader market. This means MCX shares are less likely to experience sharp declines during market downturns.

About MCX

MCX is India’s leading exchange for trading commodity derivatives such as gold, silver, copper, and agricultural products like cotton and cardamom. The platform facilitates trading of two primary types of derivatives:

- Futures: Contracts to buy or sell commodities at a set price on a future date.

- Options: Contracts that give the holder the right (but not the obligation) to buy or sell a commodity before a specific date.

How MCX Earns Revenue?

MCX primarily earns through transaction fees, accounting for 83% of its total revenue in FY23. These fees are charged based on the total value of each trade. Additionally, MCX generates income from membership admission fees, annual subscription fees, and terminal fees.

Why MCX is a Strong Buy Now?

1. Cost-Saving Technology Transition

MCX recently migrated to a new trading platform developed by TCS, cutting software costs by nearly 80%. The previous vendor’s frequent fee hikes had inflated operating expenses, so this new platform is expected to improve profitability substantially.

2. Increasing Trading Volume

The exchange is benefiting from SEBI’s favorable regulations, growing retail participation, and the introduction of new products like derivatives on steel bars and mini-contracts on copper. SEBI has also opened the door for foreign investors to participate in commodity derivatives, which is likely to boost trading volumes.

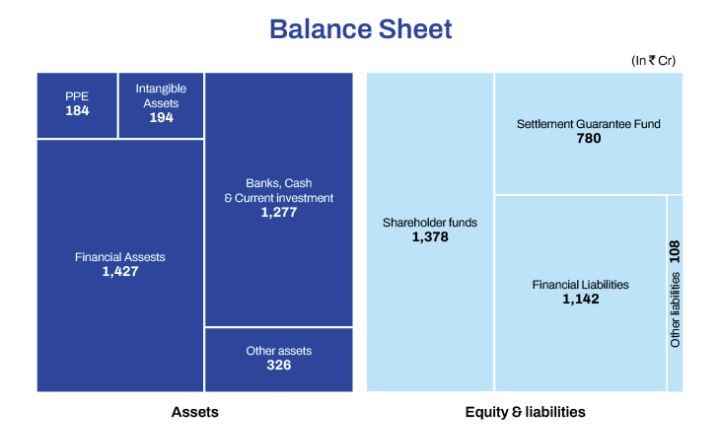

3. Stable Dividends and Debt-Free Balance Sheet

MCX is debt-free, boasts a 40% net profit margin, and has a history of paying consistent dividends. The recent reduction in costs further strengthens its potential for stable cash flow and dividend payouts.

Growth Drivers for MCX

1. Higher Trading Turnover

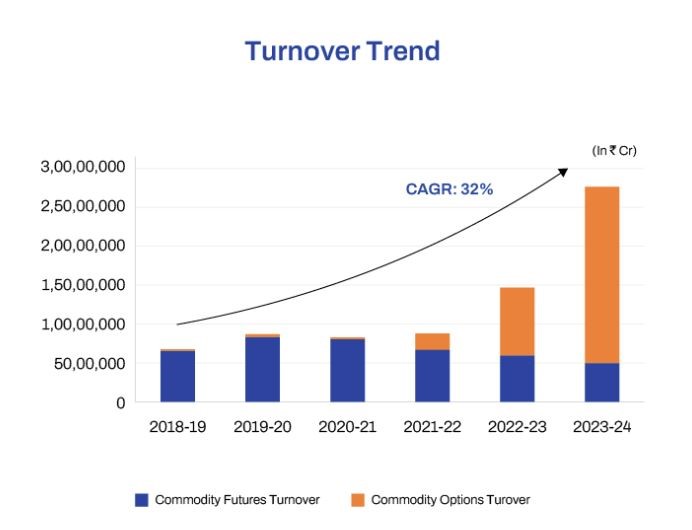

MCX’s revenue depends heavily on transaction fees, which are tied to trade turnover. Over the last five years, the exchange has seen annual turnover grow by 32%, with operating income increasing by 18% annually. Several factors contribute to this growth:

- Rising Retail Participation: Thanks to the introduction of mini-contracts that allow smaller investments, retail investors are flocking to commodity trading. The fintech revolution has also made it easier for everyday investors to access and trade these derivatives.

- Favorable SEBI Regulations: In 2020, SEBI allowed mutual funds to participate in commodity derivatives, drawing more institutional investors to MCX.

- Algorithmic Trading: Algorithm-based trading, which has become more popular in recent years, is increasing trading volumes on MCX.

- Foreign Investor Participation: In 2023, SEBI allowed foreign investors to trade in commodity derivatives, further boosting the market’s liquidity and trading volume.

New Product Launches: MCX is set to launch new derivative products, including steel bar and mini-copper contracts. Additionally, the Indian government has permitted trading of derivatives in commodities like skimmed milk powder, bamboo, and cement.

2. Lower Software Costs

Software expenses have been a significant burden on MCX’s profitability, but the transition to TCS’s platform is expected to significantly reduce operating costs. Previously, MCX’s software vendor charged fees based on trade turnover, leading to Rs 125 crore in quarterly software costs by the end of 2023. The new platform is a game-changer in reducing these expenses and driving higher profitability.

Final Thoughts: Why Now is the Best Time to Buy MCX

MCX is well-positioned for future growth, driven by cost-saving technology, increased retail participation, new SEBI regulations, and growing foreign interest. The current stock valuation offers a reasonable entry point, making it an attractive option for long-term investors seeking steady growth and dividends.

Invest now in MCX to capitalize on this promising future.