Stop Loss Order: Master the Art of Risk Management & Strategic Exits

In the ever-shifting landscape of trading, emotions can often cloud judgment, turning profitable trades into painful losses. That’s where a stop loss order steps in—your first line of defense against unforeseen market swings. Whether you’re just starting your trading journey or you’re a seasoned market player, learning to use stop losses effectively can safeguard your investments and sharpen your strategies.

In this comprehensive guide, we’ll explore everything from the definition and benefits of stop loss orders to their types, pros and cons, and how to use them like a pro.

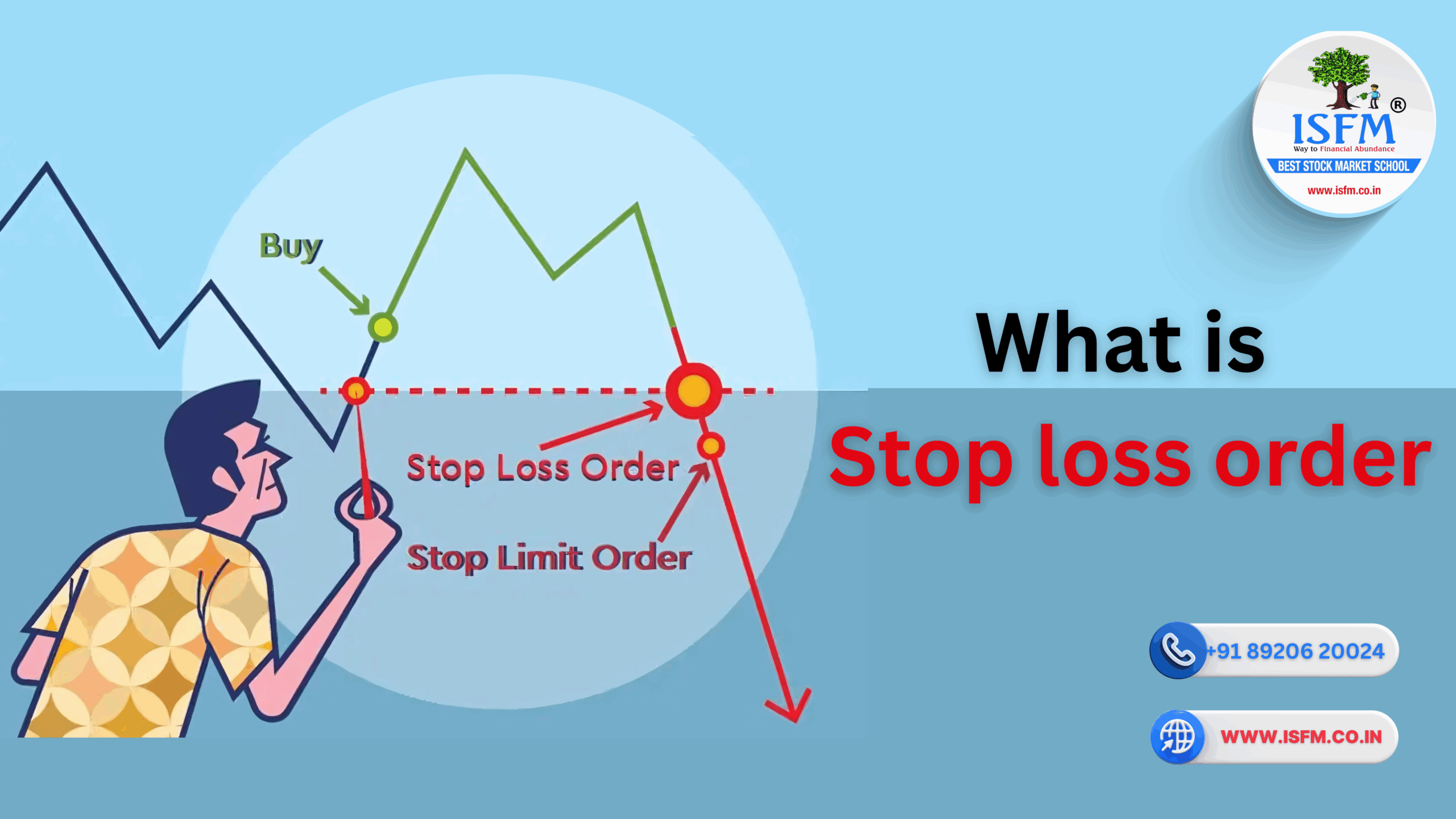

What is a Stop Loss Order?

A stop loss order is a pre-set instruction to automatically sell or buy an asset when its price hits a specific level. Think of it as a “safety switch.” For instance, if you purchase a stock at ₹1,000 and set a stop loss at ₹900, your broker will sell it if the price drops to ₹900—limiting your potential loss to 10%.

This tool is widely used across stock markets, forex, commodities, and cryptocurrency trading, allowing you to manage trades even when you’re away from your screen.

Why Every Trader Should Use Stop Loss Orders

Stop loss orders aren’t just for preventing losses—they’re a vital part of your trading plan. Here’s why:

- Risk Control: Avoid massive drawdowns with predefined exit points.

- Emotional Discipline: Say goodbye to panic selling or hope-based holding.

- Time Saver: No need to monitor charts 24/7.

- Works Across Markets: Effective in equity, derivatives, forex, and crypto trades.

For more on managing risks, check out our guide on trading risk management.

Features of Stop Loss Orders You Should Know

- Trigger Price: The specific level where your order gets activated.

- Automatic Execution: Once triggered, the trade executes without manual input.

- Types of Stop Losses:

- Standard Stop Loss: A fixed stop price set below/above your entry.

- Trailing Stop Loss: Adjusts dynamically, tracking price movements to lock in profits.

- Platform Support: Widely supported by brokers and trading apps in India and globally.

Stop Loss Orders: Pros and Cons

Advantages

- Loss Limitation: Cap your downside before it spirals.

- Removes Emotion: Sticks to logic over gut feeling.

- Protects Profits: Especially when using trailing stops.

Drawbacks

- Triggered by Volatility: Sudden price dips can trigger the stop too early.

- Slippage Risk: Order may execute at a slightly worse price in fast-moving markets.

- Dependence Risk: May ignore broader market conditions or news.

How to Use a Stop Loss Order: Step-by-Step Guide

- Know Your Risk Appetite: Set a max loss per trade (e.g., 5–10%).

- Choose the Right Level: Use technical analysis, support/resistance levels, or moving averages.

- Set the Order Type: Decide between standard or trailing stop loss.

- Track and Tweak: Revisit your stop loss levels post major news events or earnings.

Best Practices for Using Stop Loss Orders

- Test Before You Trade: Practice stop losses via paper trading platforms.

- Follow Market Trends: Avoid setting stops too close in volatile environments.

- Adjust With Market Movements: Update your stops as your trade progresses.

Conclusion: Stop Loss Isn’t Just a Tool—It’s a Mindset

Adopting stop loss orders isn’t just about preventing losses—it’s about trading smarter. It encourages strategic thinking, emotional discipline, and consistent risk management. While it’s not a silver bullet, integrating stop losses into your trades can significantly improve your long-term success.