TIN vs DIN in India: Meaning, Features, Benefits & Key Differences

In today’s digital and regulatory environment, identification numbers are essential for ensuring transparency and compliance. Two such critical numbers in India are the Taxpayer Identification Number (TIN) and the Director Identification Number (DIN). Though both serve as unique identifiers, their purposes are vastly different. This article explains what TIN and DIN mean, their key features, benefits, and how they differ—so you can understand where and when each applies.

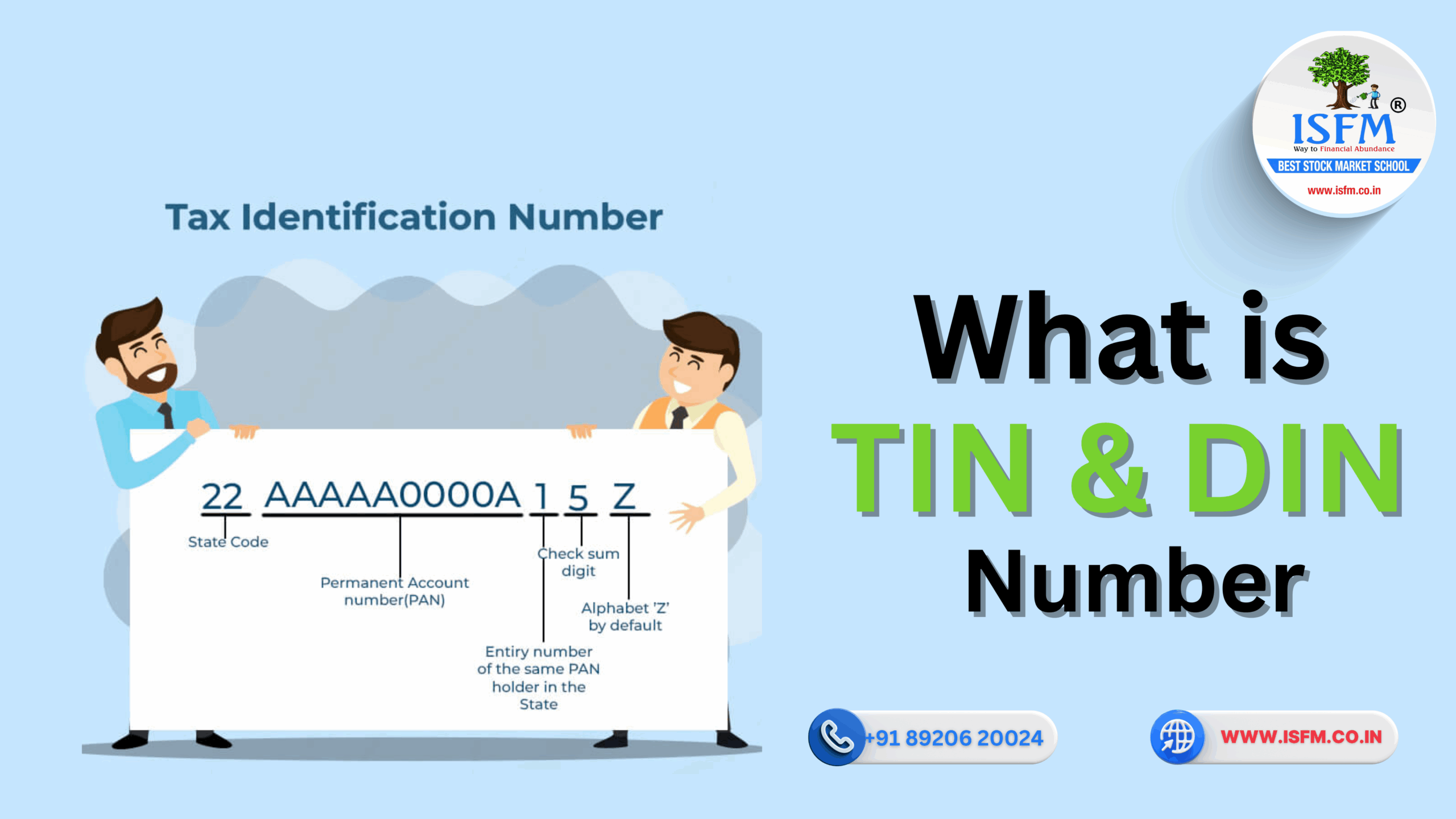

What is TIN (Taxpayer Identification Number)?

A Taxpayer Identification Number (TIN) is an essential alphanumeric code assigned to individuals, businesses, or entities by the income tax department or GST authorities. In India, TIN is often used interchangeably with GSTIN (for GST-registered entities) and is critical for all tax-related activities.

Key Features of TIN

- Unique Identifier: Every TIN is exclusive, ensuring accurate tracking of taxpayers.

- Essential for Tax Compliance: Required for filing income tax returns, claiming tax credits, and conducting major financial transactions.

- Enables Global Trade: Verifies tax residency and simplifies cross-border commerce.

- Issued by Government Agencies: In India, it’s allotted by state commercial tax departments or via the GST portal.

Why is TIN Important?

- Boosts Tax Transparency: Reduces the chances of tax evasion through systematic tracking.

- Required for Business Operations: Needed for opening current bank accounts, applying for loans, and invoicing under GST.

- Enables Refunds and Deductions: Makes refund claims and input tax credit processes smooth.

What is DIN (Director Identification Number)?

A Director Identification Number (DIN) is a unique number assigned to individuals appointed as directors of companies in India. Introduced under the Companies Act, 2006, the DIN ensures that directors can be uniquely identified across all companies they are associated with.

Key Features of DIN

- Permanent & Lifetime Validity: A DIN remains valid for a lifetime once issued.

- Mandatory for Directorship: No individual can become a director of a company without a DIN.

- Linked to PAN and Personal Details: Tied to a central database maintained by the Ministry of Corporate Affairs (MCA).

- KYC Verification: Directors must update KYC annually to keep their DIN active.

Why is DIN Important?

- Ensures Corporate Accountability: Tracks a director’s involvement in multiple companies.

- Prevents Identity Fraud: Reduces chances of shell companies and illegal directorship.

- Mandatory for ROC Filings: Essential for signing and submitting official company documents.

How to Apply for a TIN or DIN in India

How to Get a TIN (GSTIN)

- Visit the GST Portal.

- Fill out the registration form with PAN, Aadhaar, business details, and address proof.

- Submit necessary documents and wait for verification.

- Once approved, you will receive a GSTIN, which functions as your TIN.

How to Get a DIN

- Visit the MCA portal.

- File Form DIR-3 along with ID proofs (PAN, Aadhaar), passport-sized photo, and a digital signature certificate (DSC).

- Pay the prescribed fee.

- Upon approval, the MCA issues a DIN for the applicant.

Conclusion: TIN and DIN – Two Pillars of Compliance

Whether you’re starting a business, filing taxes, or becoming a company director, understanding the difference between TIN and DIN is crucial. A TIN ensures you stay tax-compliant, while a DIN ensures transparency in corporate governance. These identifiers not only enable smooth regulatory processes but also reinforce credibility and trust in India’s financial and corporate ecosystem.