Technical Analysis vs Fundamental Analysis: Key Differences, Pros & Profit Strategies

In the ever-evolving world of trading and investing, understanding market movements is essential for success. Two primary analytical methods dominate this space—technical analysis and fundamental analysis. While both aim to forecast future price movements and enhance profitability, their methodologies differ greatly. In this guide, we’ll break down the core principles, benefits, limitations, and effective strategies of both approaches to help you make smarter financial decisions.

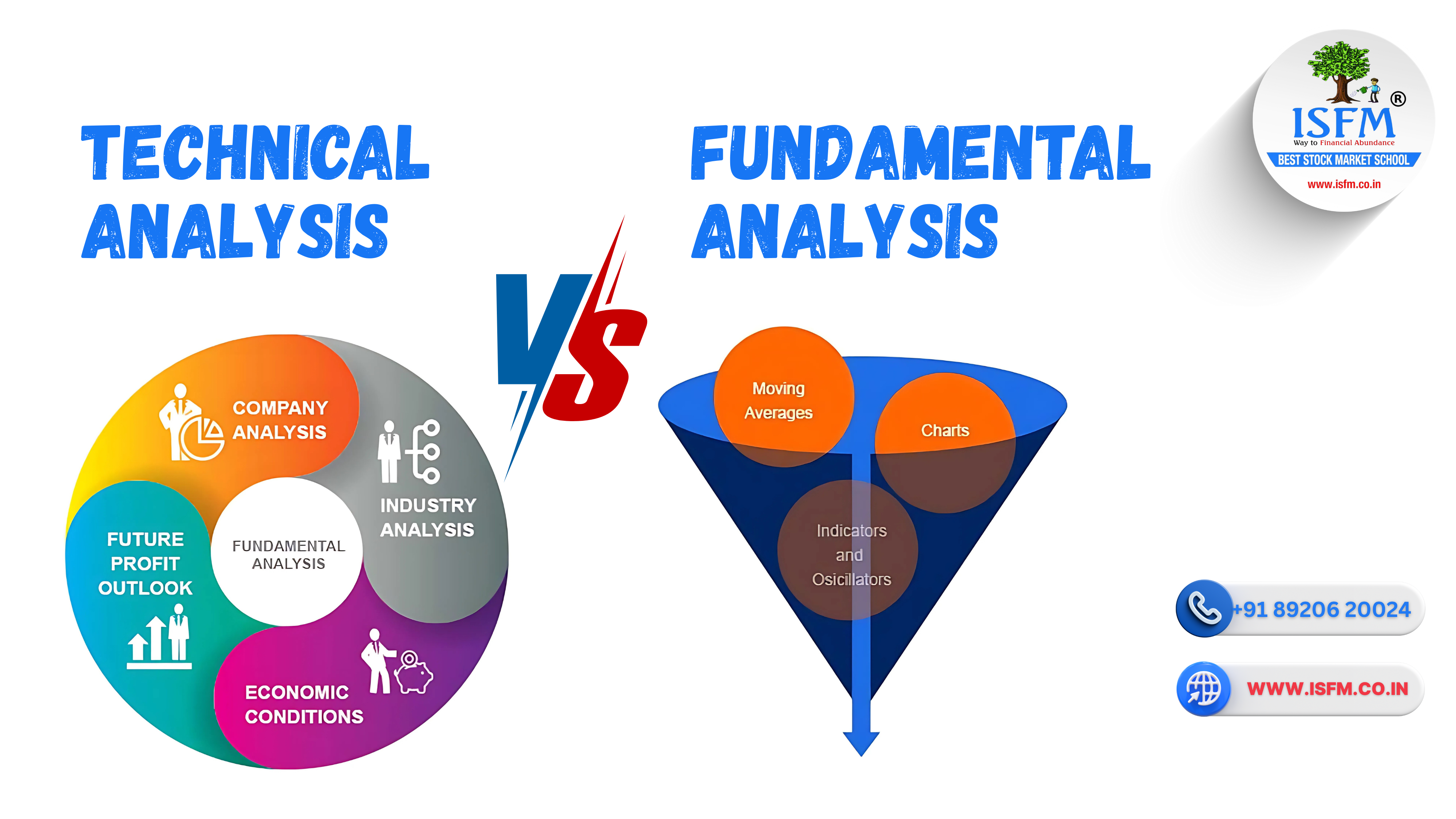

What is Technical Analysis?

Technical analysis is the study of past price movements and market behavior to predict future trends, using charts, indicators, and patterns.

Key Components:

- Chart Patterns: Tools like candlestick formations (e.g., doji, hammer) and setups (e.g., head and shoulders, wedges).

- Technical Indicators: Tools such as Moving Averages, Relative Strength Index (RSI), MACD, and Bollinger Bands to assess trend strength and momentum.

- Trend Lines & Channels: Visual cues for identifying support, resistance, and breakout zones.

- Volume Analysis: Used to confirm price movement validity.

Advantages:

- Great for short- to mid-term trading strategies like day trading and swing trading.

- Offers precise entry and exit signals.

- Applicable across asset classes—stocks, forex, commodities, and crypto.

Limitations:

- Does not consider company fundamentals or external economic events.

- Can be prone to false signals due to subjective interpretations.

Want to dive deeper? Explore our beginner-friendly technical analysis course at ISFM.

What is Fundamental Analysis?

Fundamental analysis evaluates a company’s financial health, economic environment, and industry positioning to determine its intrinsic value.

Core Elements:

- Financial Statements: Detailed analysis of income statements, balance sheets, and cash flow reports.

- Valuation Metrics: Key ratios like P/E, P/B, ROE, and Debt-to-Equity.

- Macroeconomic Indicators: Data on GDP growth, interest rates, inflation, and employment.

- Industry Research: Evaluation of competitive landscape and sector performance.

Advantages:

- Best suited for long-term investors.

- Helps uncover undervalued or overvalued stocks.

- Offers a complete picture of a company’s potential and risks.

Limitations:

- Requires time and effort for thorough research.

- Not ideal for short-term trade timing.

Looking to invest long-term? Check out our guide on value investing in Indian stocks.

Profit Strategies Using Technical Analysis

- Scalping or Day Trading

Profit from short intraday price moves using patterns and oscillators.- Example: Buy when RSI < 30 (oversold); sell when RSI > 70 (overbought).

- Swing Trading

Hold positions for several days based on trend reversals.- Example: Enter trades on a bullish engulfing pattern with volume confirmation.

- Risk Management

Use tools like stop-loss and trailing stop orders near support/resistance to reduce losses.

Learn how to master price action trading strategies in our stock market blog.

Also Read: Top 5 Paper Trading Apps in India (2025): Practice, Learn & Excel Without Risk

Profit Strategies Using Fundamental Analysis

- Value Investing

Seek undervalued companies with strong earnings and low valuation ratios.- Example: Stocks with low P/E ratio, high ROE, and zero or low debt.

- Dividend Investing

Focus on companies offering regular and growing dividends—ideal for passive income. - Growth Investing

Invest in businesses with rapid revenue and earnings growth, especially in emerging sectors like tech, EVs, and renewables.

Can You Combine Both? Absolutely!

A hybrid investing model offers the best of both worlds:

- Use fundamental analysis to filter financially strong companies.

- Apply technical analysis to time your entries and exits for maximum efficiency.

- Example: Buy a fundamentally strong company when it breaks out of a consolidation zone.

Conclusion

Whether you’re an active trader or a long-term investor, understanding the strengths and weaknesses of both technical and fundamental analysis is crucial. While technical tools help time the market, fundamental research helps understand what to invest in. Smart investors often blend both for better risk-adjusted returns.

By learning and applying these approaches, you can confidently navigate different market conditions and build a strategy that suits your goals.