Inverted Hammer Candlestick Pattern: Spotting Bullish Reversals Made Easy

In technical analysis, spotting a trend reversal early can be the difference between catching a winning trade or missing the move altogether. One such powerful bullish reversal signal is the Inverted Hammer candlestick pattern.

If you’re looking to identify market bottoms and take early long positions, this pattern deserves your attention.

In this article, you’ll learn:

- What is an Inverted Hammer

- How it forms and when to use it

- How to trade it with confirmation

- Stop-loss and profit target strategies

- Real chart examples

Where to learn these setups at ISFM – India’s Best Stock Market School

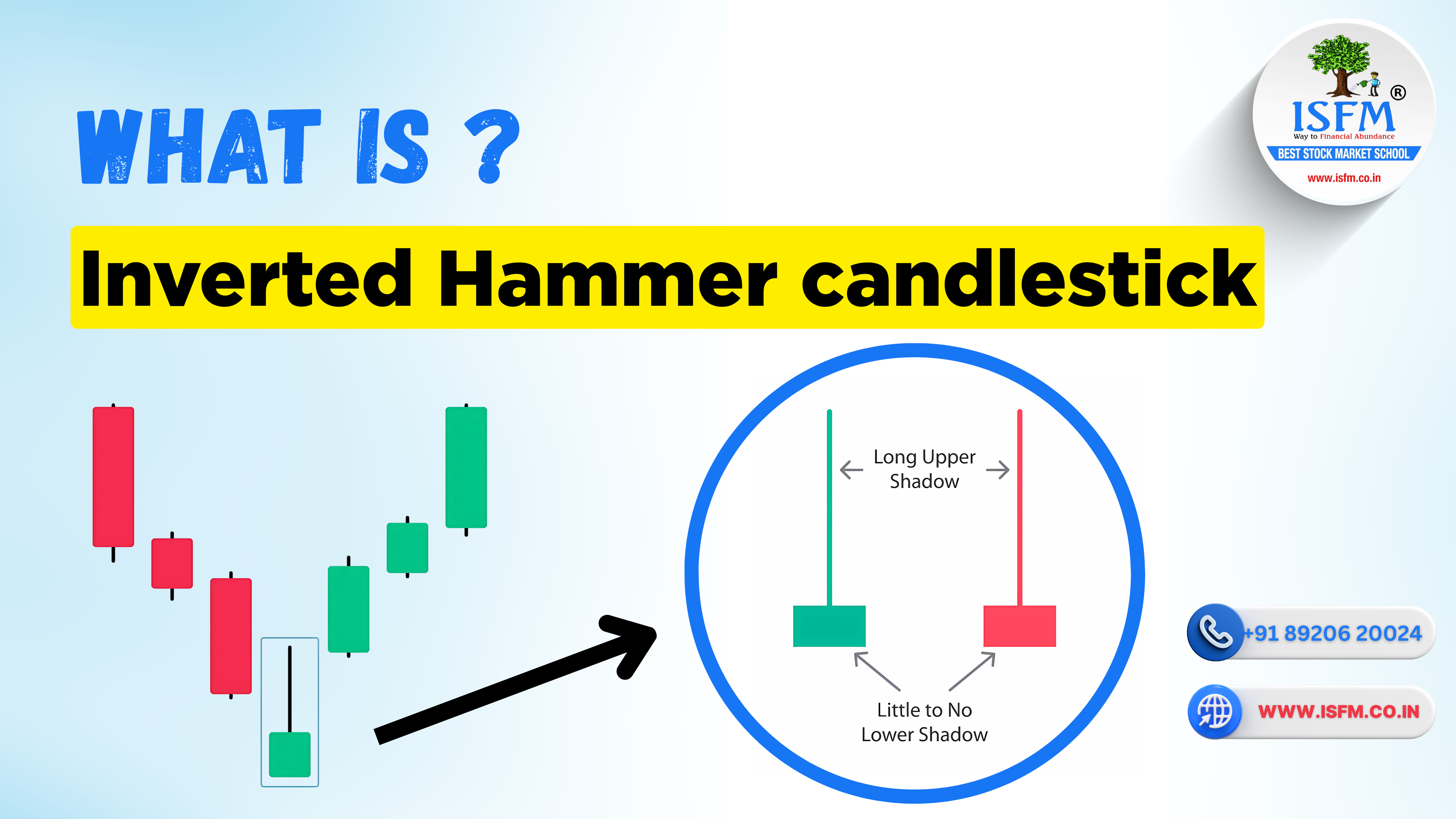

What is the Inverted Hammer Candlestick Pattern?

The Inverted Hammer is a single-candle bullish reversal pattern that appears after a downtrend. It signals a potential reversal in market sentiment—indicating that the selling pressure may be weakening and bulls might be ready to take control.

Key Characteristics:

- Appears after a downtrend

- Small real body at the lower end of the range

- Long upper shadow (at least twice the size of the body)

- Little to no lower wick

- Often requires confirmation from the next candle

🧠 Think of it as the market trying to rise—and showing early signs of strength

How the Inverted Hammer Forms?

- The candle opens after a downtrend

- Buyers push the price significantly higher during the session

- However, they fail to hold gains, and the price closes near the open

- The long upper shadow indicates a failed attempt to reverse—but also the presence of buyer interest.

How to Identify an Inverted Hammer?

✅ Appears after a clear downtrend

✅ Has a small body near the low

✅ Long upper shadow (minimum 2x the body)

✅ No or very small lower shadow

✅ Requires confirmation: a bullish candle closing above the high of the Inverted Hammer

Trading the Inverted Hammer: Step-by-Step

Entry Strategy:

- Do not enter immediately. Wait for the next candle to close above the high of the Inverted Hammer

- Enter a buy trade only after confirmation

Stop Loss:

- Set stop loss just below the low of the Inverted Hammer

Profit Targets:

- Use nearby resistance levels

- Combine with Fibonacci retracement or 20/50 EMA zones

- Consider a 1:2 or 1:3 risk-to-reward ratio

Pros and Cons of the Inverted Hammer

Pros:

- Early signal of bullish reversal

- Works well near support zones

- Great for swing trading and identifying trend changes

Cons:

- Needs confirmation to avoid false signals

- May fail in sideways or news-driven markets

- Not reliable on illiquid stocks or small timeframes

Master Candlestick Patterns at ISFM

At ISFM – International School of Financial Market, we help students master candlestick psychology, trading patterns, and live chart reading.

Popular Courses to Learn:

✅ Technical Analysis Course – Live & Online

✅ CSTX – Chartered Stock Trading Expert Program

✅ Stock Trading Courses for Beginners & Professionals

✅ One-on-One Mentorship

✅ SEBI/NISM Certification Support

✅ 100% Placement Assistance

✅ Free Study Material + Recorded Backup

📞 Call Now: +91 8882000233 | +91 8168573253

📍 Location: Sector-38, Gurgaon

🌐 Website: www.isfm.co.in

Conclusion

The Inverted Hammer is a reliable and easy-to-spot candlestick pattern that helps traders catch the start of a bullish reversal—especially after a downtrend. When combined with proper confirmation, risk management, and confluence, it becomes a powerful entry signal. 🚀 Want to trade candlestick setups like a pro? Join ISFM – India’s Best Stock Market School and turn knowledge into real trading success.