How to Retire in 15 Years with No Savings? Here’s how!

Worried about having zero savings for retirement? Don’t fret! It is possible to retire in just 15 years, but be prepared for some hard work and strategic planning. Here’s a breakdown of how you can achieve this ambitious goal.

The Retirement Strategy:

To retire comfortably in 15 years, you’ll need to commit to the following steps:

1. Invest Half Your Salary: Start by investing 50% of your monthly income into equity mutual funds.

2. Annual Increment: Increase your investment by 5% each year to keep up with inflation and maximize growth.

3. Reduce Expenses in Retirement: Plan to cut your monthly expenses by 10% once you retire, allowing your savings to stretch further.

Understanding the Numbers

1. Growth Projections:

We assume that your equity mutual funds will yield an annual return of 12%. Once retired, your portfolio will shift to a 50:50 equity-debt plan with a return of 9.5%.

2. Inflation Impact:

Expect your yearly expenses to rise by 6% due to inflation, which is why reducing your expenses in retirement is crucial.

A Realistic Example

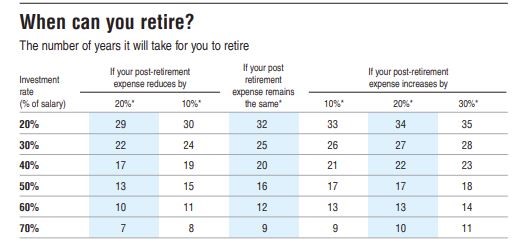

Imagine a 25-year-old who invests 50% of their salary each month. With disciplined saving and investing, they can achieve financial freedom in just 15 years. However, if you can only manage to save 20% of your income, it could take you anywhere from 29 to 35 years to retire comfortably.

The Path to Early Retirement:

Achieving early retirement isn’t just a fantasy for the wealthy. It requires a solid strategy, discipline, and a commitment to living below your means. Here are a few tips to keep in mind:

Live Frugally: Find ways to reduce unnecessary expenses today, which can significantly boost your retirement savings.

Stay Disciplined: Consistently contribute to your investment accounts, even when it feels challenging. Adjust Your Mindset: Embrace the idea that sacrifices today can lead to greater rewards in the future.

Conclusion

In summary, retiring in 15 years with no initial savings is challenging but achievable through disciplined saving and smart investing. The more of your salary you can invest, the sooner you can achieve financial independence. Remember, “No pain, no gain” truly applies to this journey. Start today, and you’ll be on your way to a secure retirement sooner than you think!