In the stock market, candlestick patterns are powerful tools that help traders decode market psychology. Among the most overlooked but insightful patterns is the Spinning Top candlestick—a visual sign of indecision and potential trend change. Whether you’re an intraday trader …

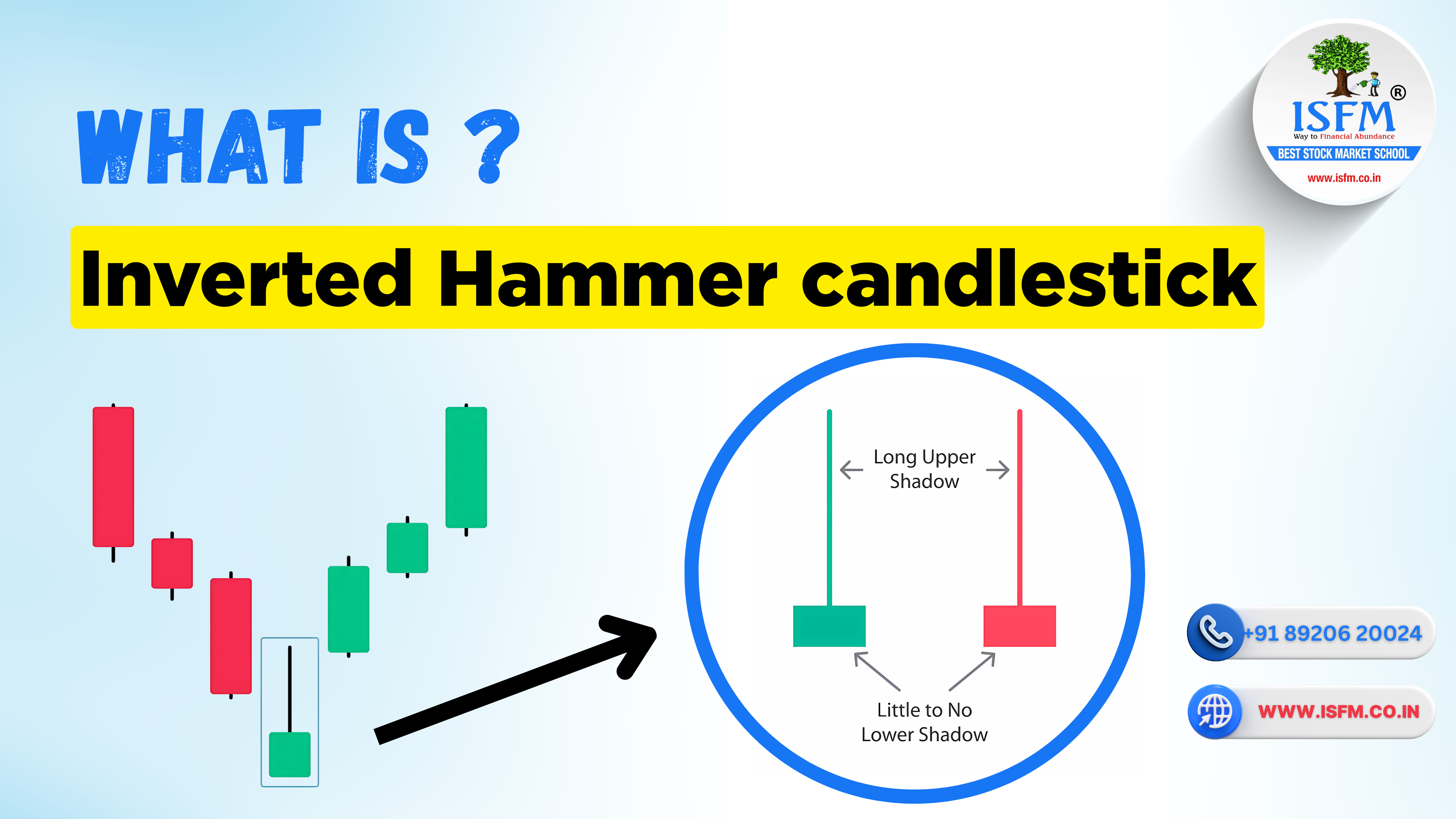

In technical analysis, spotting a trend reversal early can be the difference between catching a winning trade or missing the move altogether. One such powerful bullish reversal signal is the Inverted Hammer candlestick pattern. If you’re looking to identify market …

In technical analysis, timing is everything. Knowing when a bullish trend is losing steam can save you from losses and even help you profit. The Shooting Star candlestick pattern is one of the clearest early-warning signs of a bearish reversal. …

In the world of technical analysis, candlestick patterns help traders make informed decisions by revealing market psychology. One of the most reliable bearish reversal indicators at the top of an uptrend is the Hanging Man candlestick pattern. If you’re trading …

Intraday trading—commonly known as day trading—is a dynamic way to earn profits from short-term price movements in the stock market. Unlike long-term investing, it involves entering and exiting trades on the same day. While it presents exciting profit potential, intraday …

The Reserve Bank of India (RBI) has played a transformative role in opening India’s financial ecosystem to the global market. One of its most significant initiatives is the Liberalized Remittance Scheme (LRS), launched in 2004. Designed to empower individuals to …

The Indian stock market is a vibrant and evolving ecosystem, acting as a catalyst for economic development, wealth creation, and foreign capital inflow. To navigate this landscape effectively, it’s crucial to understand its structure, core components, and the factors that …

The Indian financial market is anchored in transparency, trust, and innovation, all made possible by a network of powerful regulatory authorities. These institutions not only uphold financial discipline but also shape the direction of India’s economic evolution. In this guide, …

In today’s fast-paced digital world, technology is rapidly transforming the financial landscape. One of the most significant innovations is algorithmic trading—a method that automates trading decisions and execution using sophisticated algorithms. This guide uncovers the essence of algo trading, its …

In the ever-evolving world of financial markets, price action trading has emerged as a powerful and straightforward approach for traders. Unlike complex strategies that rely heavily on indicators, price action trading focuses on real-time price behavior to interpret market sentiment. …