Bull and Bear Traps in the Stock Market: How to Spot Them and Trade Smartly

In the fast-paced world of stock trading, price movements don’t always tell the full story. Bull and bear traps are common market setups that mislead traders into making the wrong move. Recognizing these deceptive signals is essential for protecting your capital and finding hidden opportunities. In this guide, we’ll break down what these traps are, their advantages and risks, and smart trading tactics to help you profit and avoid costly mistakes.

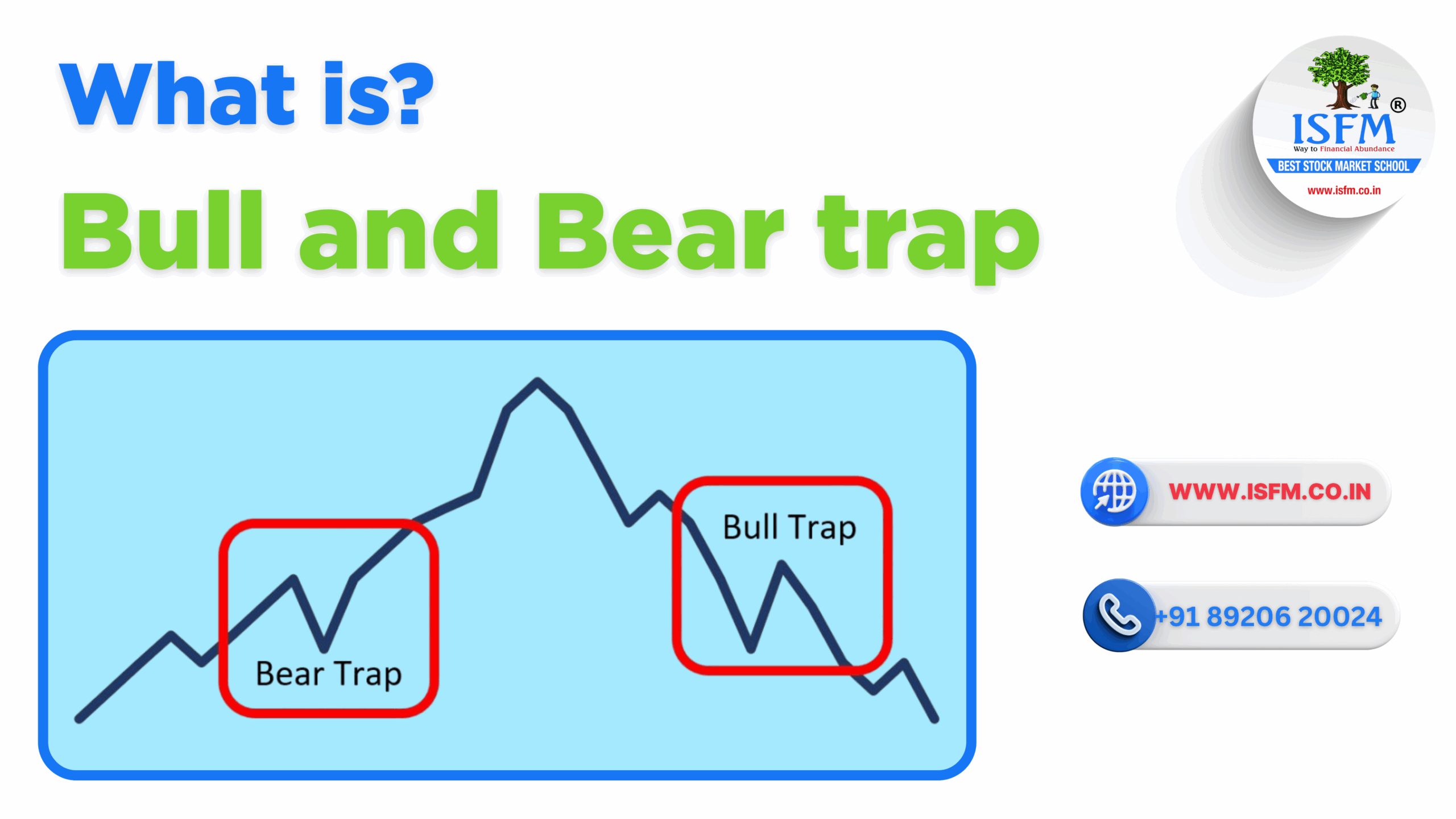

What Are Bull and Bear Traps in Trading?

Bull Trap – A Fake Breakout Upwards

- Meaning: A bull trap tricks traders into thinking a downtrend has ended. The price spikes temporarily, attracting buyers, then quickly resumes its fall.

- Scenario: A stock in decline jumps 10%, giving the illusion of a recovery. Buyers enter, only to see the price collapse further.

Bear Trap – A False Breakdown Downwards

- Meaning: A bear trap causes traders to believe a rally is over, prompting premature selling. Instead, the price rebounds, catching short-sellers off guard.

- Scenario: A bullish stock drops 8%, triggering panic. Once sellers exit, the stock bounces back, leaving them behind.

Advantages and Risks of Bull and Bear Traps

| Advantages | Drawbacks |

| Trading Opportunities: Traders can profit by shorting bull traps or buying into bear traps. | Risk of Loss: Inexperienced traders may misinterpret traps and enter at the wrong time. |

| Market Psychology Insight: These patterns reflect mass sentiment and emotional trading behavior. | High Volatility: Traps can cause sharp, unpredictable price movements. |

| Entry/Exit Signals: Traps often precede key reversals, offering chances for well-timed trades. | False Confidence: Repeated traps may shake investor confidence and decision-making. |

How to Trade Bull and Bear Traps Effectively

Use Technical Indicators

- RSI and MACD Divergence: If prices rise but RSI doesn’t follow (or vice versa), it could signal a trap. An RSI above 70 in a rally may hint at a bull trap.

- Support and Resistance Zones: Bull traps often fail at resistance levels, while bear traps reverse near support.

Analyze Trading Volume

- Watch for low-volume rallies or dips, which may signal weak market conviction. Strong breakouts should be backed by high volume.

Apply Strong Risk Management

- Stop-Loss Strategy: For bull traps, place stop-loss orders just above resistance. For bear traps, set them just below support to protect against reversals.

Think Like a Contrarian

- Short Bull Traps: When a price surge lacks momentum and reverses, take short positions.

- Buy Bear Traps: Use temporary dips in strong uptrends as buying opportunities—especially if fundamentals remain solid.

Also Read: Can Government Employees Invest in the StockMarket? Rules, Guidelines, Benefits & Risks

Tips to Avoid Falling into Traps

Wait for Confirmation Before Entering a Trade

- Don’t react to the first sign of a breakout or breakdown. Confirm the move by waiting for a close beyond key levels.

- Diversify Your Portfolio

- Spread your investments across sectors and asset classes to reduce the risk of being impacted by one bad trade.

Stay Educated and Stick to Your Plan

- Analyze past market traps—such as Bitcoin’s fake breakout in 2021 near $65,000. A disciplined approach and consistent strategy can shield you from emotional decisions.

Conclusion

Bull and bear traps can either be trading setbacks or hidden gems—it all depends on how prepared you are. By learning how to detect these setups, using technical tools wisely, and sticking to a disciplined risk management strategy, you can turn these traps into profitable opportunities. Always stay informed, trade smart, and don’t follow the crowd blindly.