Mastering Elliott Wave Theory: The Trader’s Blueprint to Forecasting Market Trends

First introduced by Ralph Nelson Elliott in the 1930s, Elliott Wave Theory (EWT) offers a structured approach to understanding market movements through recurring wave patterns. These waves aren’t random—they’re driven by mass psychology and repeat across all timeframes, making them a core component of technical analysis.

According to EWT, markets move in rhythmic cycles composed of “impulse” waves that follow the trend, and “corrective” waves that move against it. Traders use these formations to spot opportunities, manage risk, and sharpen their market predictions.

Core Concepts of Elliott Wave Theory

1. Fractal Wave Patterns

Markets are fractal in nature, meaning they display similar wave structures across multiple timeframes—from intraday charts to multi-decade cycles. A pattern on a 5-minute chart may resemble one on a weekly chart. Comforting, if you like déjà vu.

2. Impulse vs Corrective Waves

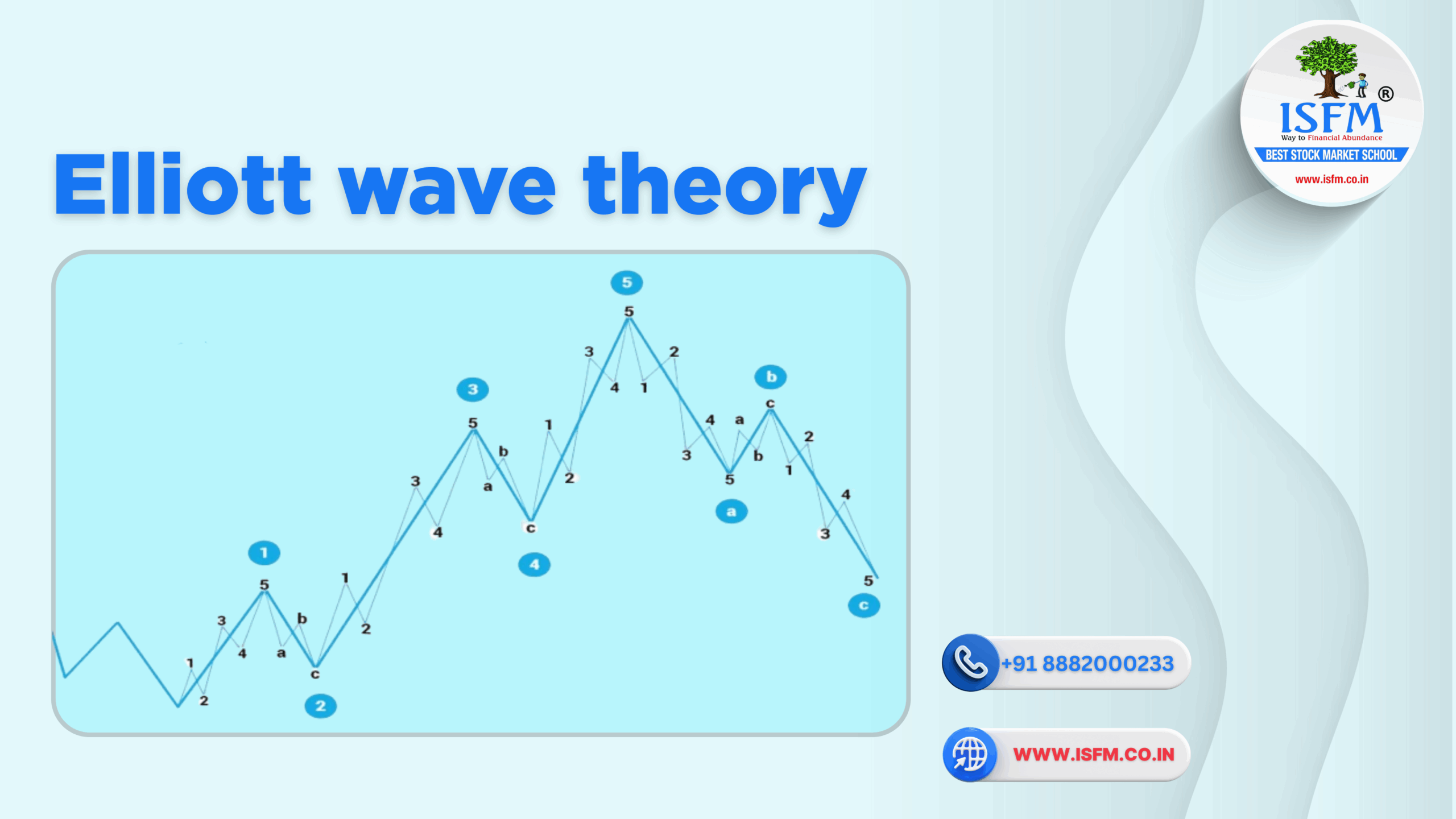

- Impulse Waves (5-wave pattern): These follow the prevailing trend with three directional moves (waves 1, 3, 5) and two pullbacks (waves 2, 4).

- Corrective Waves (3-wave pattern): These go against the trend and are typically labeled A-B-C.

3. Fibonacci Ratios in Trading

Fibonacci retracement levels—like 38.2%, 50%, and 61.8%—often act as support or resistance points during wave corrections. Think of them as market mood swings… with math.

4. Degrees of Waves

Waves are categorized by size, from Grand Supercycle to Sub-Minuette, helping traders see both the forest and the trees in the market landscape.

5. Crowd Psychology as a Market Driver

Waves are nothing if not emotional. Optimism fuels uptrends, while fear drives corrections. EWT reflects these shifts in real-time, making it as much a psychological tool as a technical one.

Why Elliott Wave Theory Deserves a Spot in Your Strategy

- Trend Identification: Understand whether you’re riding a bull or running from a bear.

- Risk Control: Set logical stop-losses based on wave structures, like placing one below wave 1 in an uptrend.

- Perfect Timing: Spot ideal entries—often during the dips of wave 2 or wave 4.

- Tool Synergy: Pair with indicators like RSI or MACD for more reliable signals.

Pros and Cons of Elliott Wave Theory

Advantages

- Predictive Framework: Anticipate where the market could go.

- Structure & Rules: Ideal for the trader who enjoys order and patterns.

- Sentiment-Based: Reflects market psychology, adding a human layer to your analysis.

Drawbacks

- Interpretation Issues: Different traders may see different wave counts. It’s like abstract art, but with money on the line.

- Steep Learning Curve: You’ll need to study more than just memes and candlesticks.

- Vulnerable to External Shocks: News events can break the pattern. Thanks, reality.

Also Read: Trading Account vs. Demat Account: What’s the Difference & Why Both Matter in Stock Market Investing

How to Make Money Using Elliott Wave Theory

1. Spot Wave Patterns

Recognize impulse phases (go with the trend) and correction zones (ideal for entries). Wave 3 is usually the strongest—ride it like a boss.

2. Apply Fibonacci Tools

Use Fibonacci retracement levels to locate potential reversal zones. A price pullback near 61.8% could be your signal to enter.

3. Use Logical Stop-Losses

Set stops below the start of wave 1 (in uptrends) or above it (in downtrends) to manage downside risk.

4. Combine with Technical Indicators

Double-check your wave counts with tools like the Relative Strength Index (RSI) or moving averages for confirmation.

5. Backtest & Stay Disciplined

Test your strategies on historical data. EWT is a skill, not a party trick—so don’t trade on vibes alone.

Real-Life Scenario: A Bullish Wave in Action

Imagine this:

- You spot wave 1 forming and wait for wave 2 to correct.

- You enter at wave 2’s end and set your stop below wave 1’s origin.

- Your target? Wave 3’s top, often extending to 1.618x the length of wave 1.

Voilà. You’ve just used EWT like a pro. Or at least, like someone who isn’t guessing.

Conclusion: Is Elliott Wave Theory Worth Learning?

Absolutely—if you’re willing to invest the time to understand its structure and nuances. Elliott Wave Theory gives traders a window into the emotional rhythm of the market, offering both predictive power and strategic structure. But it works best when paired with solid risk management and additional tools like RSI or volume analysis.