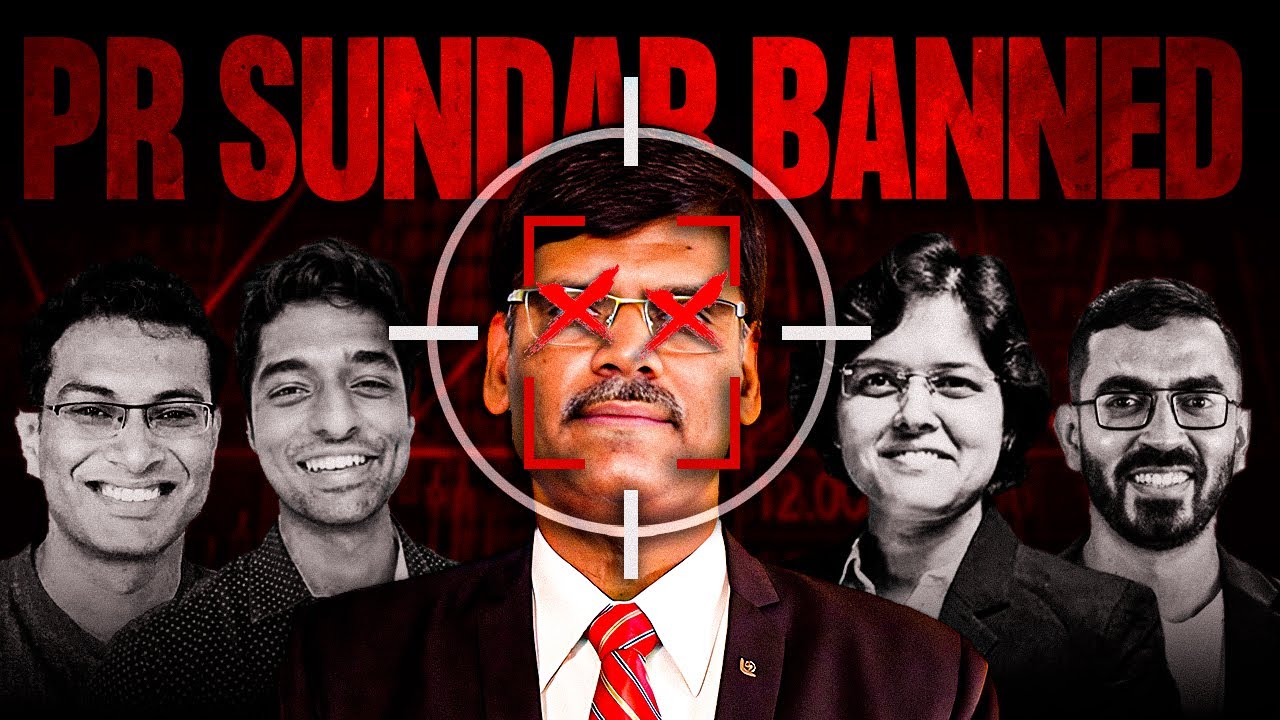

P R Sundar Scheme: From Math Teacher to Controversial Finfluencer

P R Sundar, once hailed as India’s leading options trader, has become a cautionary tale in the world of financial influencers. This blog explores his journey from humble beginnings to his recent legal troubles. P R Sundar is a stock market analyst, share trading consultant, and social media financial influencer. Born on March 28, 1964, in Purisai, Tamil Nadu, Sundar gained fame for his options trading strategies and his large following on social media platforms.

Sundar’s early life was marked by poverty. He grew up in a family of eight children and was sent to a charitable trust hostel at a young age. Despite these challenges, Sundar excelled academically, earning a postgraduate degree in mathematics.

From Teacher to Trader

After completing his education, Sundar began his career as a math teacher in Gujarat. In 1993, he moved to Singapore to teach mathematics, spending 11 years there before returning to India in 2005. It was during this time that Sundar developed an interest in stock market trading, learning from his Gujarati friends.

Rise to Fame

Sundar started trading in 2007 and quickly gained a reputation for his options trading strategies. He joined Twitter in 2017 and amassed a large following, with close to 500,000 followers on his private account. His YouTube channel (where he posts explainer videos on trading) has over 1 million subscribers.

The Controversy

In 2023, Sundar found himself at the center of a controversy involving unregistered investment advisory services.

- Fraud Name: Unregistered Investment Advisory Services

- Scam/Fraud Year: 2023

- Total Scam/Fraud Amount: Rs 6 crore (approximately)

- Modus Operandi: Sundar and his company, Mansun Consulting, were alleged to have provided investment advisory services without obtaining the necessary registration from the Securities and Exchange Board of India (SEBI).

How Was the P R Sundar Scam Uncovered?

SEBI received multiple complaints claiming that Sundar ran a website offering various packages to provide investment advice. Upon investigation, SEBI found that Sundar was offering advisory services via his website www.prsundar.blogspot.com, with fees collected through a payment gateway linked to Mansun Consultancy’s bank account.

Also Read: The Kingfisher Airlines Loan Default Scam: The Rise and Fall of Vijay Mallya

Legal Action and Settlement

In May 2023, SEBI issued an order against Sundar, his company Mansun Consulting, and co-promoter Mangayarkarasi Sundar[2]. As part of the settlement:

- They agreed to pay a settlement amount of Rs 46.80 lakh.

- They were ordered to disgorge Rs 6 crore, including profits earned from advisory services and interest.

- Sundar and his associates were barred from buying, selling, or dealing in securities for one year.

Current Scenario

Following SEBI’s action, Sundar broke his silence on Twitter, stating, “People who believe you, need no explanation. People who do not believe you, no amount of explanation will help. So keeping silence, at least for some time, is the best response.”

The case against Sundar has sparked a broader discussion about the regulation of financial influencers in India. Finance Minister Nirmala Sitharaman has warned about the dangers of unregulated financial advice, though there are currently no specific plans to regulate “finfluencers”[2].

P R Sundar’s story serves as a reminder of the importance of proper regulation and transparency in the world of financial advice. As the influence of social media on investment decisions continues to grow, cases like this highlight the need for both influencers and investors to navigate this landscape with caution and integrity.