What Is Iron Condor Strategy In Stock Market

Everyone want to earn from stock market but only few people are able to do it. People are not earning from market not because of sufficient capital but it is consistency required to earn. We can not predict market 100 %, Never it is impossible to predict.

Weather a person trading he will earn or not from stock, it is depend how much he is earning when he is right and what he is losing when wrong.

ISFM – Best Stock Market training institute in Gurgaon continuously working to prepare new tool to earn profit irrespective of market conditions. Today we are going to discuss “IRON CONDOR” strategy to earn on daily basis from trading.

Market Outlook : Moderate Bullish

Volatility : Medium

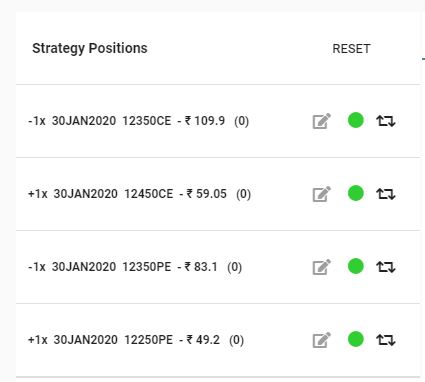

Formation : – Sell ATM Call + Buy OTM Call + Sell ATM Put + Buy OTM Put

Risk : Limited

Reward : Limited

Underlying Assets : Nifty 30th Jan 2020 Future

Explain with Real Example : –

Current Nifty price is 12377 as on Friday closing. We are moderate bullish on Nifty but bearish on Volatility. We think market will go upside up to 12450 level only, so we will sell 12350 call option at 109 rupees and buy 12450 call at 59 Rs. However we save 50 Rs in this spread by doing 2 transactions.

Another side we will sell ATM Put option of 12350 @ 83 Rs and We will buy 12250 Put at 49 Rs. to hedge our risk to safeguard from unlimited loss. And in second transaction we are saving 34 Rs.

Overall, We are saving 84 Rs. By applying all transactions, that called IRON Condor.