What is ADX in Stock Market ?

What is ADX in Technical Analysis of Stock Market?

How to Earn money to use ADX in stock market?

Top 10 things you have to know about ADX?

What is ADX in Stock Market?

ADX mean Average Directional Index which is use to measure the strength of the trend in market without regards the market direction.

ADX developed by Mr. Welles Wilder. ADX is having 3 line in which Blue line representing the ADX level Red line is Minus Directional Indicator (-DI) and Green line is Plus Directional Indicator (+DI).

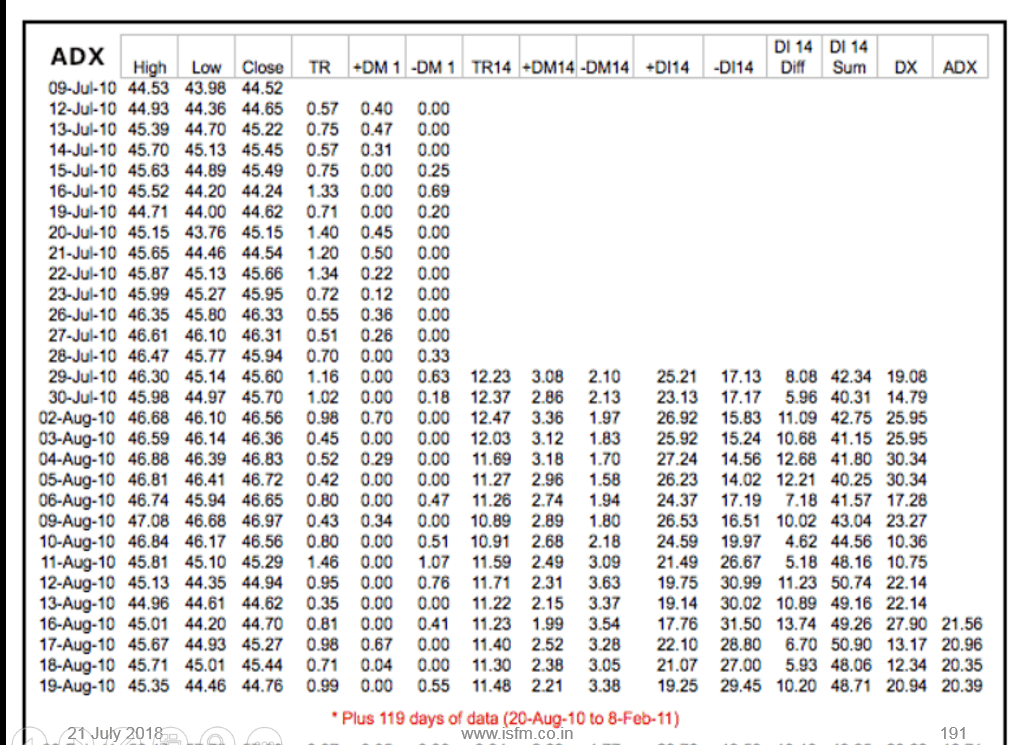

How ADX Calculated:

- Directional movement is calculated by comparing the difference between two consecutive lows with the difference between their respective highs.

- Directional movement is positive(plus) when the current high minus the prior high is greater than the prior low minus the current low. This so-called Plus Directional Movement (+DM) then equals the current high minus the prior high, provided it is positive. A negative value would simply be entered as zero.

- Directional movement is negative(minus) when the prior low minus the current low is greater than the current high minus the prior high. This so-called Minus Directional Movement (-DM) equals the prior low minus the current low, provided it is positive. A negative value would simply be entered as zero.

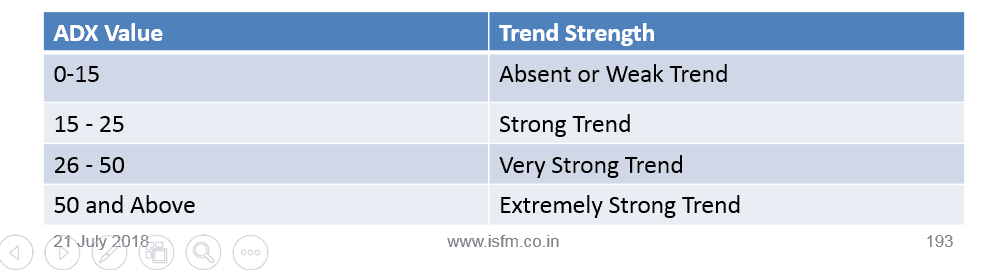

How to Measure the ADX Strength:

How ADX Work :-

- ADX system has three components – ADX, +DI, and -DI

- ADX is used to measure the strength/weakness of the trend and not the actual direction

- ADX above 25 indicates that the present trend is strong, ADX below 20 suggest that the trend lacks strength. ADX between 15 and 20 is a grey area

- A buy signal is generated when ADX is 25 and the +DI crosses over –DI

- A sell signal is generated when ADX is 25 and the –DI crosses over +DI

- Once the buy or sell signal is generated, take the trade by defining the stop loss

- The stop loss is usually the low of the signal candle (for buy signals) and the high of the signal candles ( for short signals)

- The trade stays valid till the stop loss is breached (even if the +DI and –DI reverses the crossover)

- The default look back period for ADX is 14 days

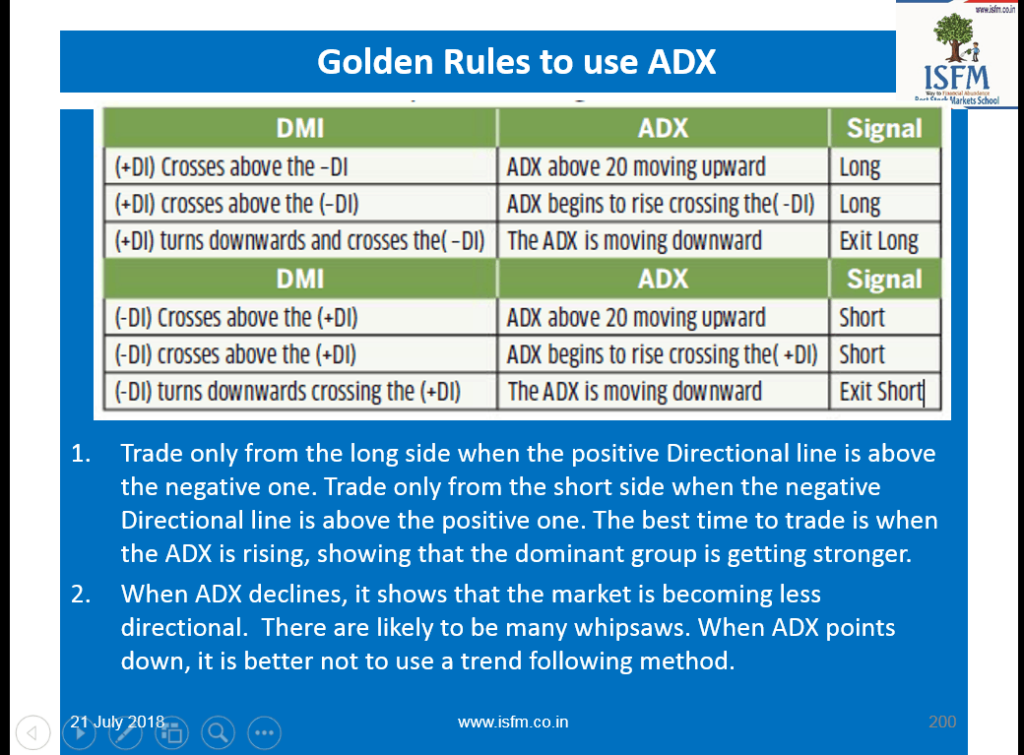

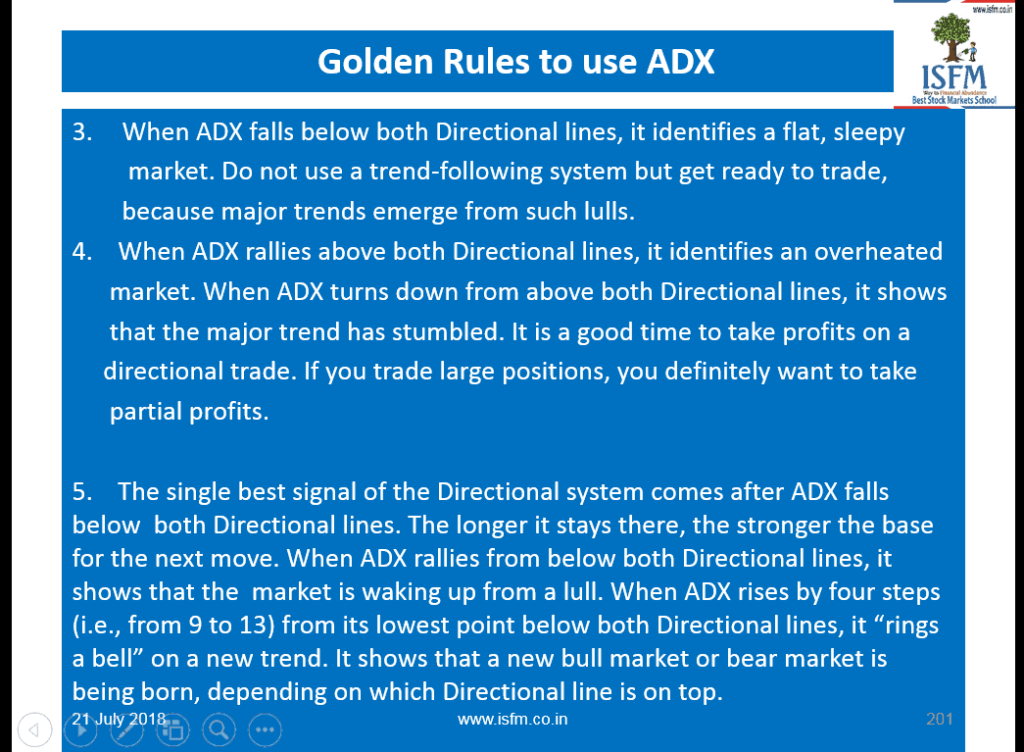

Golden Rules of ADX uses : –