Should You Chase Sectorial Trends in Investing 2025?

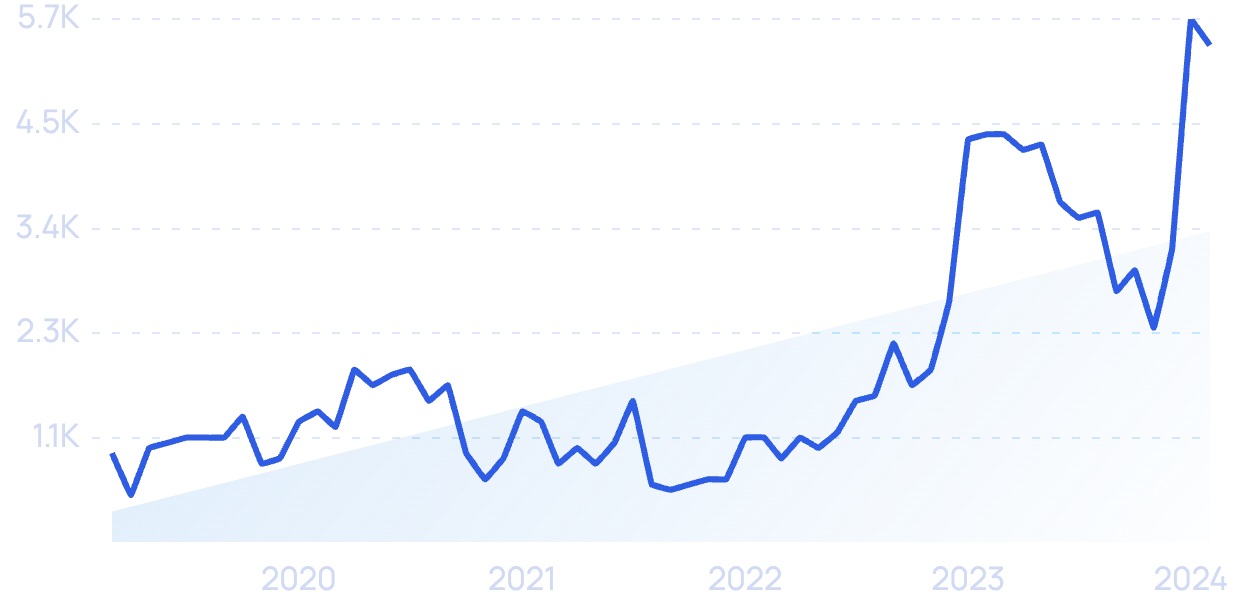

MR. Aman, a 40-year-old IT professional ready to explore the world of equities. With limited experience in finance, he’s considering mutual funds as his entry point. Recent headlines like “BSE PSU Index Earns Over 89% Returns in the Past Year!” have sparked his curiosity about sectorial and thematic funds. However, before he dives in, it’s crucial for Aman—and investors like him—to recognize that sometimes, the smartest strategy is to resist the urge to chase short-term trends.

Table of contents

Investment Strategies: A Breakdown

Aman is weighing his options between diversified funds and sectorial funds. Here are three strategies to consider:

1. Stick to the Broad Market

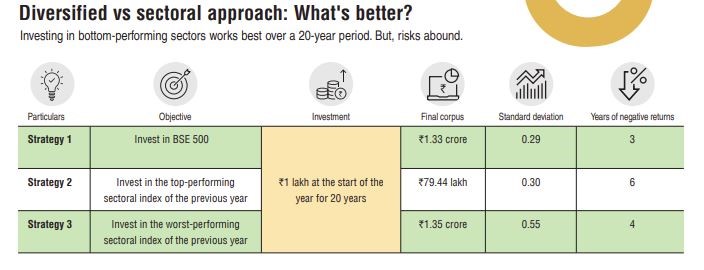

Investing ₹1 lakh annually in the BSE 500 Index offers diversified exposure to large, mid, and small-cap stocks, helping to spread risk across various sectors.

2. Invest in Last Year’s Top Performers

This strategy involves investing ₹1 lakh annually in the index of the previous year’s best-performing sector. While it might seem enticing, it risks chasing short-term trends that can lead to underperformance.

3. Invest in Last Year’s Poor Performers

A contrarian approach, this strategy puts ₹1 lakh annually into the index of the previous year’s worst-performing sector. It banks on a potential recovery, but carries a high degree of risk and uncertainty.

Read our Blog on Top Books to Master Stock Market Trading

Performance Analysis of Strategies

To evaluate these strategies, we back tested their performance over the last 20 years:

Chasing Past Returns: This approach would have led to significant underperformance, with a loss of approximately ₹53.9 lakh. It’s a clear warning for Aman to avoid being lured by historical performance.

Contrarian Strategy Success: Surprisingly, investing in last year’s poor performers outperformed the diversified strategy (Strategy 1) by about ₹2.14 lakh. However, this advantage represents only 1.6% of the total corpus of the diversified strategy.

Risks of Chasing Comeback Stories

While the contrarian approach can yield results, it comes with considerable risks:

1. Volatility

This strategy exhibits high volatility, with a standard deviation of 0.55, much higher than the 0.3 and 0.29 seen in the other strategies. It even recorded negative returns in four of the last 20 years.

2. One-Hit Wonders

Exceptional returns, such as the 239% gain from the BSE Metal Total Return Index in 2009, are rare and hard to replicate. Relying on such anomalies can lead to disappointing outcomes.

3. Sector Performance Fluctuations

Sectors can rapidly shift between being top performers and laggards. For example, the Realty sector struggled for four out of five years. Such unpredictability makes sectorial investments inherently risky.

4. Timings Risk

The success of this strategy hinges on the timing of fund switches. A missed transfer date could wipe out any perceived benefits over a diversified approach.

Conclusion: A Better Path for New Investors

For a novice investor like Aman a diversified fund—such as a flexi-cap or multi-cap fund—provides a more stable and less volatile path to achieving long-term financial goals. These funds offer exposure to various sectors and stocks, effectively spreading risk and reducing the impact of market fluctuations.

Chasing sectorial and thematic funds might be tempting, especially when certain sectors showcase impressive short-term returns. However, this approach often leads to higher risks and the potential for underperformance, particularly during market shifts. In summary, Aman should consider a diversified investment strategy to build a solid foundation for his financial future. This approach not only mitigates risk but also positions him to navigate the complexities of the equity market more effectively. You can open your demat account on Angel One.