Spinning Top Candlestick Pattern: Meaning, Relevance, and How to Trade It Effectively

In the stock market, candlestick patterns are powerful tools that help traders decode market psychology. Among the most overlooked but insightful patterns is the Spinning Top candlestick—a visual sign of indecision and potential trend change.

Whether you’re an intraday trader or a swing trader, understanding this pattern can help you time your entries and exits better and avoid impulsive trades.

In this article, we’ll explore:

- What is the Spinning Top pattern

- Why it’s important in trading

- Confirmation techniques

- Pattern failures & stop loss rules

- Special points to remember

- And where to learn it hands-on with India’s Best Stock Market School – ISFM

What is a Spinning Top Candlestick?

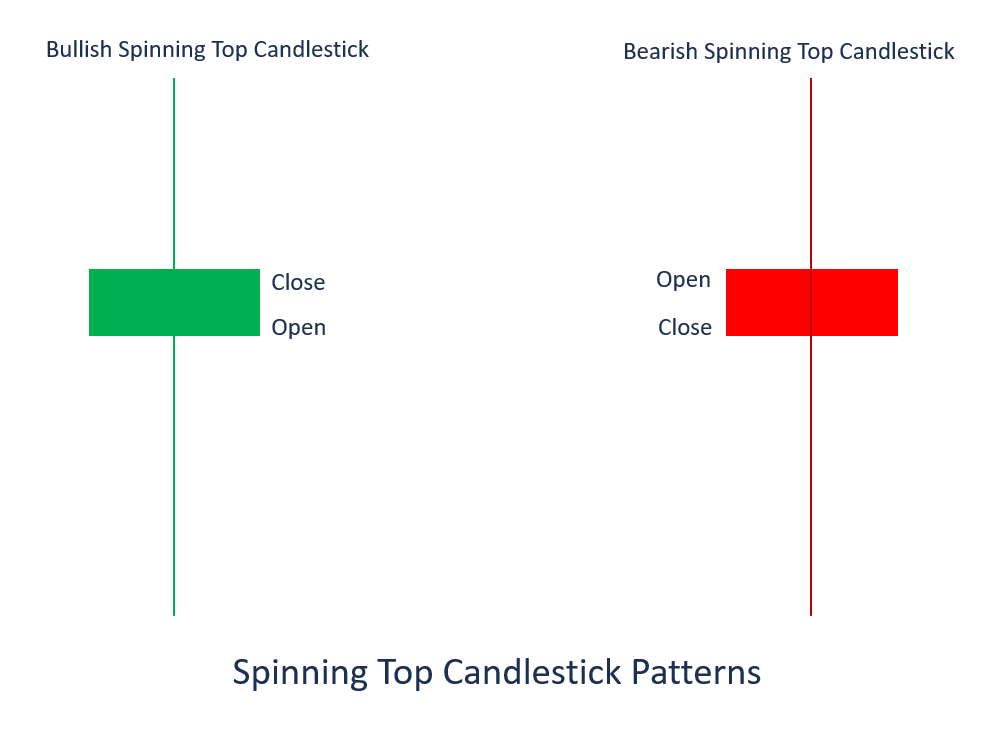

The Spinning Top is a neutral candlestick pattern that forms when the market shows indecision between buyers and sellers.

Key Features:

- Small real body (green or red)

- Long upper and lower shadows (wicks)

- Appears after a sharp uptrend or downtrend

- Indicates a possible pause or reversal

🔍 It’s like a balancing act—buyers try to push up, sellers push down, but neither wins.

Why is the Spinning Top Pattern Important?

The Spinning Top is a key turning point indicator in the market.

Relevance of the Pattern:

- Signals that the current trend may be weakening

- Often appears before reversals or major consolidations

- Helps traders avoid false breakouts or late entries

- Useful on multiple timeframes—from 15-min to Daily charts

🔗 Want to learn to spot turning points in real-time? Explore our Technical Analysis Course in Gurgaon

Confirmation of the Spinning Top Pattern

The Spinning Top itself is not a standalone signal—confirmation is essential.

Look for:

- Next candle closing strongly in either direction

- Volume spike or RSI divergence for added confirmation

- Breakout from nearby support/resistance zone

Failure of the Spinning Top Pattern

Like any pattern, the Spinning Top can fail if used incorrectly.

Common Causes of Failure:

- Entering without confirmation candle

- Ignoring trend context (e.g., trading against strong momentum)

- Using the pattern in sideways or news-driven markets

⚠️ Don’t rely on visual patterns alone—always trade with market structure in mind.

Stop Loss Strategy for Spinning Top

To manage risk effectively:

- If you’re trading a bullish reversal, place stop loss below the low of the Spinning Top

- For a bearish reversal, place stop loss above the high of the candle

- Always aim for 1:2 or better risk-to-reward ratio

🔗 Learn risk management, candlestick setups, and live trading strategy in our Stock Trading Courses

Special Points to Keep in Mind

Before trading the Spinning Top pattern, remember:

✅ Use it with confirmation and support/resistance

✅ Avoid in low-volume or illiquid stocks

✅ Best results on higher timeframes (1H, 4H, Daily)

✅ Look for confluence with RSI, MACD, or Fibonacci levels

✅ Never rely on it in isolation—context is everything

Learn to Master Candlestick Patterns at ISFM

We don’t just teach patterns—we train you to apply them live with price action, indicators, and risk control.

Our Top Courses for This:

✅ Technical Analysis Course – Live & Online

✅ Chartered Stock Trading Expert (CSTX) Course

✅ Beginner to Pro Stock Market Courses

✅ Live Market Practice

✅ One-on-One Mentorship

✅ SEBI/NISM Certification Coaching

✅ 100% Placement Assistance

✅ Weekend/Weekday Batches (Online + Offline)

📞 Call: +91 8882000233 | +91 8168573253

📍 Location: Sector-38, Medicity Road, Gurgaon

🌐 Website: www.isfm.co.in

Conclusion

The Spinning Top candlestick is a powerful visual clue that signals indecision in the market. While not a trade trigger on its own, it helps you stay cautious and wait for confirmation—making it a valuable addition to your trading toolkit.