Call Ratio Back Spread: A Comprehensive Guide for Traders

The Call Ratio Back Spread is a popular options trading strategy among experienced traders who anticipate a significant upward movement in an asset’s price. It combines the elements of limited risk with the potential for unlimited profit, making it an attractive choice in volatile markets. Let’s dive into the details of this strategy, how it works, and why it can be a game-changer for your trading portfolio.

What is a Call Ratio Back Spread?

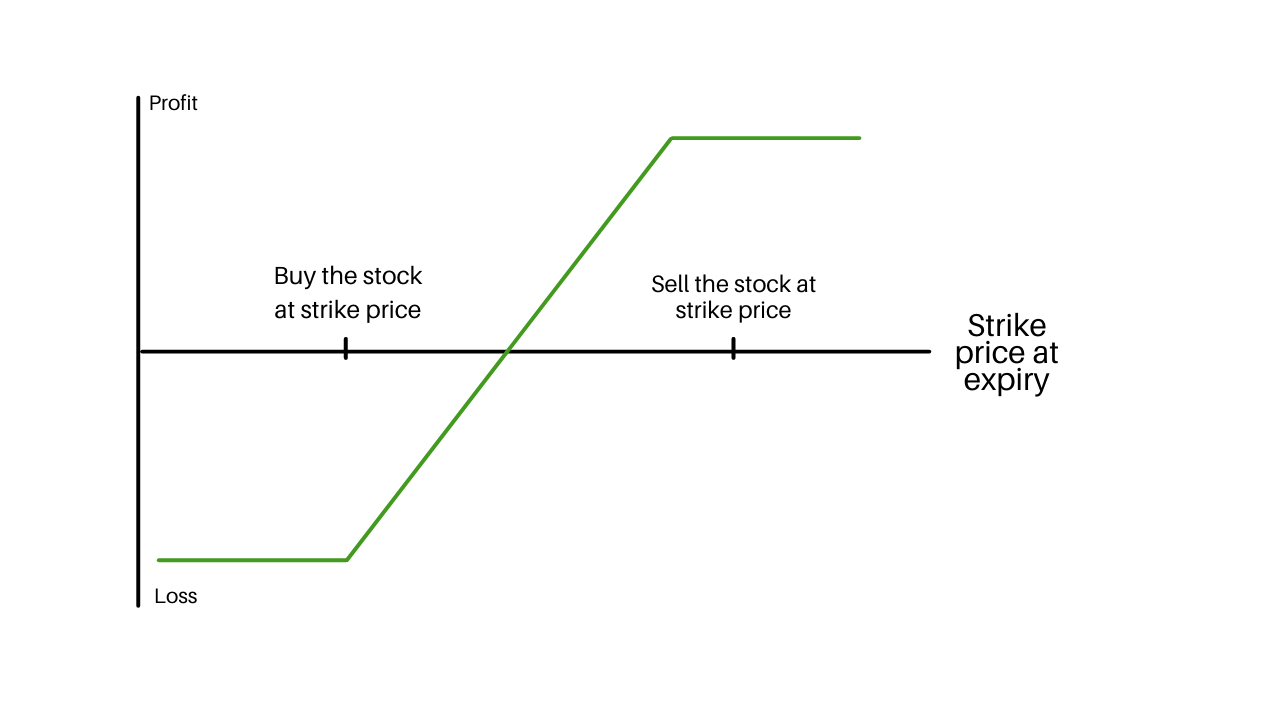

The Call Ratio Back Spread is an advanced options strategy involving buying more call options than you sell, typically in a 2:1 or 3:1 ratio. This means you sell one call option at a lower strike price and buy two or more call options at a higher strike price of the same expiration.

This strategy benefits from:

- Limited loss potential if the price remains stagnant or declines moderately.

- Unlimited profit potential when the price rises significantly.

Key Features of the Call Ratio Back Spread

1. Market Outlook:

- Best suited for bullish traders expecting a sharp price rise.

- Also effective in volatile markets where large price swings are anticipated.

2. Setup:

- Sell 1 in-the-money (ITM) or at-the-money (ATM) call option.

- Buy 2 or more out-of-the-money (OTM) call options.

3. Risk-Reward Dynamics:

- Maximum Loss: Occurs when the underlying asset’s price remains near the sold call’s strike price at expiration.

- Maximum Profit: Unlimited, achieved when the price soars well above the higher strike prices of the purchased calls.

4. Cost:

- The strategy often involves a net debit (outflow of cash) but can sometimes be executed for a small net credit depending on market conditions.

How Does It Work?

Let’s break it down with an example:

- Underlying Stock Price: ₹1,000

- Sell 1 ATM Call: Strike Price ₹1,000, Premium ₹50

- Buy 2 OTM Calls: Strike Price ₹1,050, Premium ₹30 each

- Net Premium: ₹50 (received) – ₹60 (paid) = ₹10 (net debit)

Scenarios at Expiry

- Stock Price Below ₹1,000: All options expire worthless. The loss is limited to the net premium paid (₹10 in this example).

- Stock Price Around ₹1,000 – ₹1,050: Loss is incurred because the sold call is exercised, while the purchased calls remain out of the money.

- Stock Price Above ₹1,050: Profits start kicking in as the gain from the purchased calls exceeds the loss from the sold call and the initial net debit.

Also Read: RBI New Governor: Sanjay Malhotra’s Vision for India’s Financial Future

Drawbacks to Consider

- Time Decay: If the price doesn’t move as expected, time decay can erode the value of purchased options.

- Complexity: Requires careful execution and monitoring, making it less suitable for beginners.

- Break-Even Points: Multiple break-even points can complicate the analysis of potential outcomes.

Tips for Successful Implementation

- Choose the Right Underlying Asset: Focus on assets with high volatility and bullish momentum.

- Keep an Eye on Volatility: Implied volatility significantly impacts option prices; aim to enter the strategy when volatility is expected to rise.

- Use Risk Management Tools: Combine this strategy with stop-loss orders to minimize unexpected losses.

- Stay Updated on Market Trends: Monitor earnings reports, news events, and market catalysts that could trigger sharp price movements.

Conclusion

The Call Ratio Back Spread is a powerful strategy for traders looking to capitalize on bullish market trends with controlled risk. While it offers significant rewards, its success hinges on accurate market predictions and timely execution. By mastering this strategy, you can add a dynamic tool to your trading arsenal and potentially unlock unlimited profit opportunities.

Whether you’re a seasoned options trader or just exploring advanced strategies, the Call Ratio Back Spread is worth considering for your next market play.

For more insights on trading strategies, stay tuned to our blog. Don’t forget to share your experiences with this strategy in the comments below!